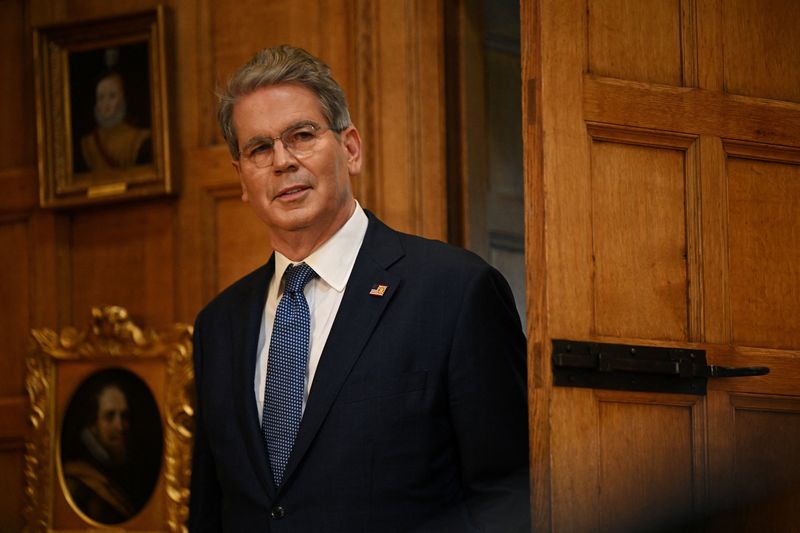

Syria’s Sharaa, in New York, renews call for US to formally drop sanctions

PositiveFinancial Markets

In a recent appearance in New York, Syria's Deputy Foreign Minister Faisal Mekdad, also known as Sharaa, has renewed calls for the United States to formally lift sanctions imposed on Syria. This appeal is significant as it highlights ongoing diplomatic efforts to improve relations and address humanitarian concerns in the region. The lifting of sanctions could pave the way for economic recovery and stability in Syria, which has been severely affected by years of conflict.

— Curated by the World Pulse Now AI Editorial System