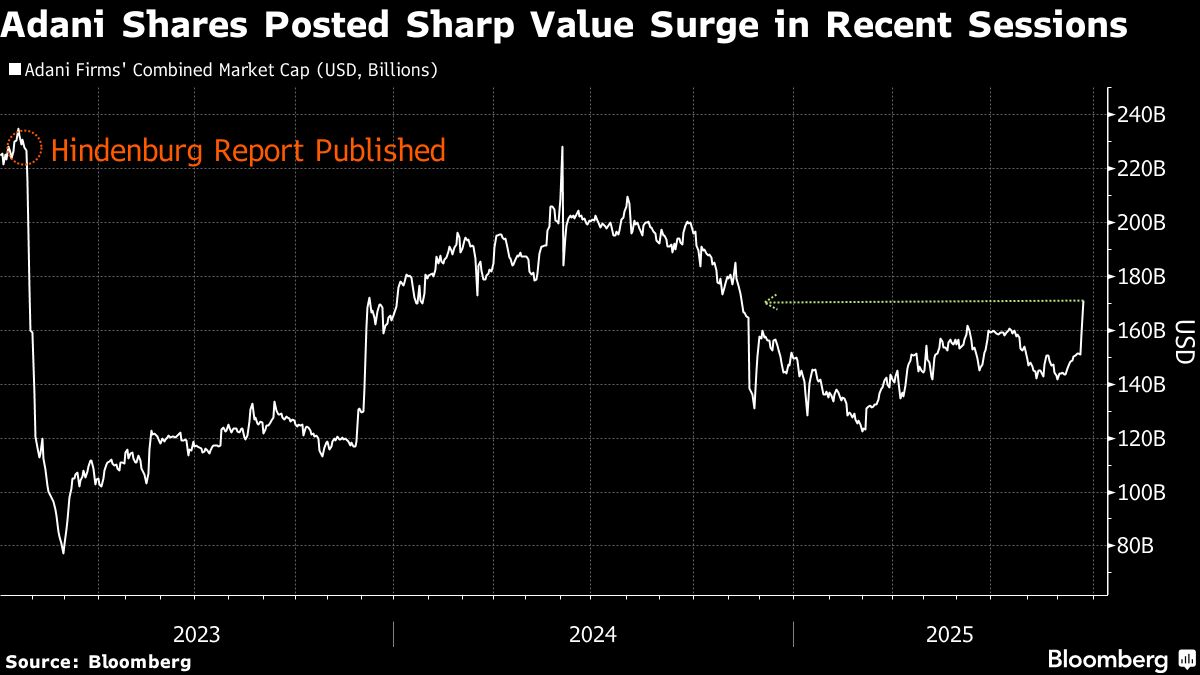

Adani Group Shares Add Almost $20 Billion as Rally Extends

PositiveFinancial Markets

Adani Group shares have surged, adding nearly $20 billion to the company's market value as the rally continues. This significant increase reflects investor confidence and could indicate a positive trend for the broader market, making it an important development for stakeholders and analysts alike.

— Curated by the World Pulse Now AI Editorial System