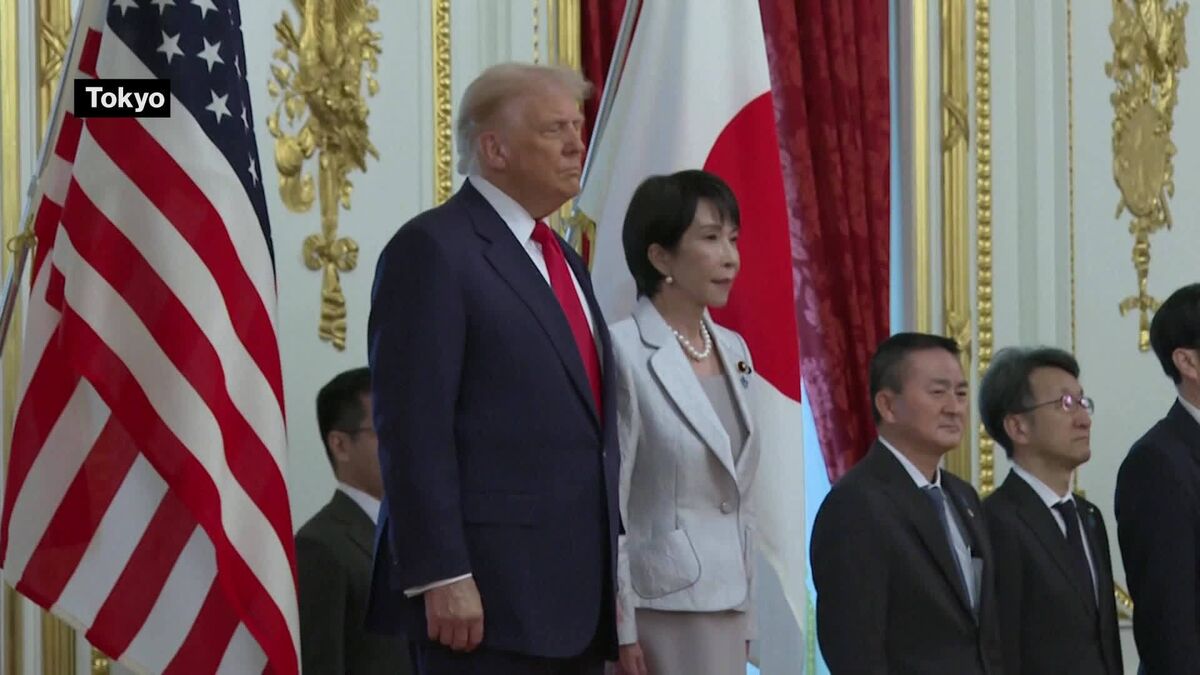

Investors Await Clarity After Xi-Trump Meet: UBS’s Tay

NeutralFinancial Markets

Investors are eagerly awaiting insights from the upcoming meeting between Donald Trump and Xi Jinping, as highlighted by Kelvin Tay from UBS. This meeting is crucial because it could shape economic policies and market dynamics, impacting global investments and trade relations.

— Curated by the World Pulse Now AI Editorial System