Gold Holds Drop as Traders Focus on US-China Trade, Credit Woes

NeutralFinancial Markets

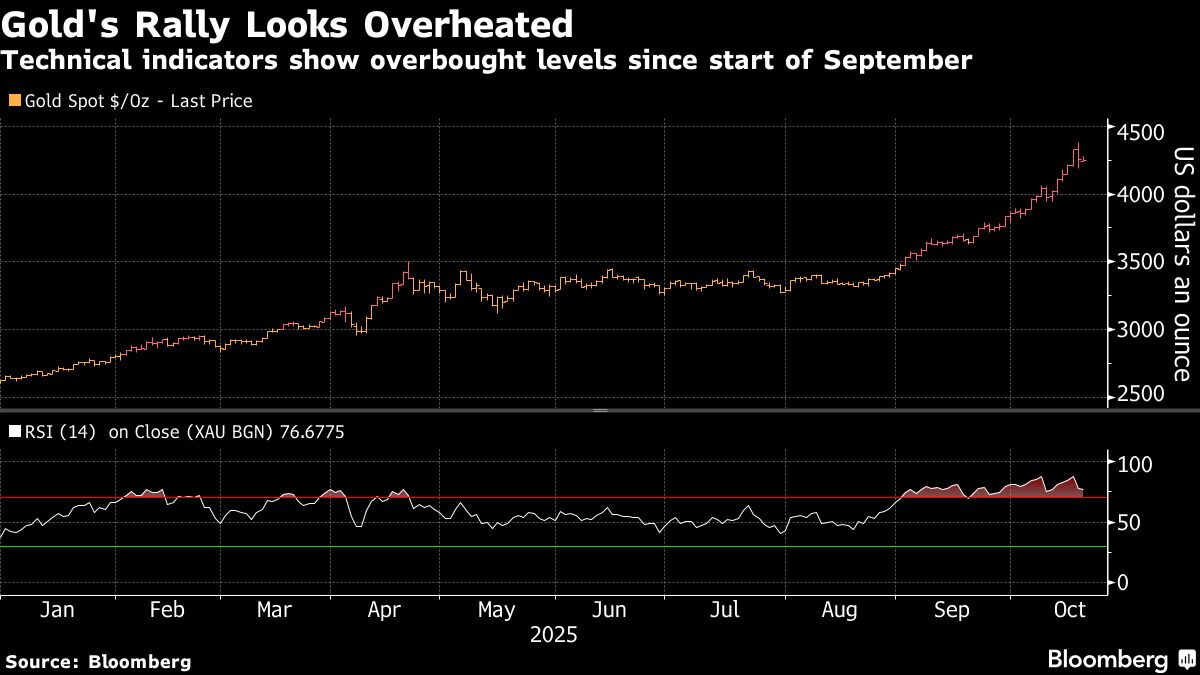

Gold prices have stabilized after a significant drop, as traders are closely monitoring the ongoing trade tensions between the US and China, along with concerns about the credit risks facing regional banks in the US. This situation is crucial as it reflects the broader economic climate and can influence investment decisions across various markets.

— Curated by the World Pulse Now AI Editorial System