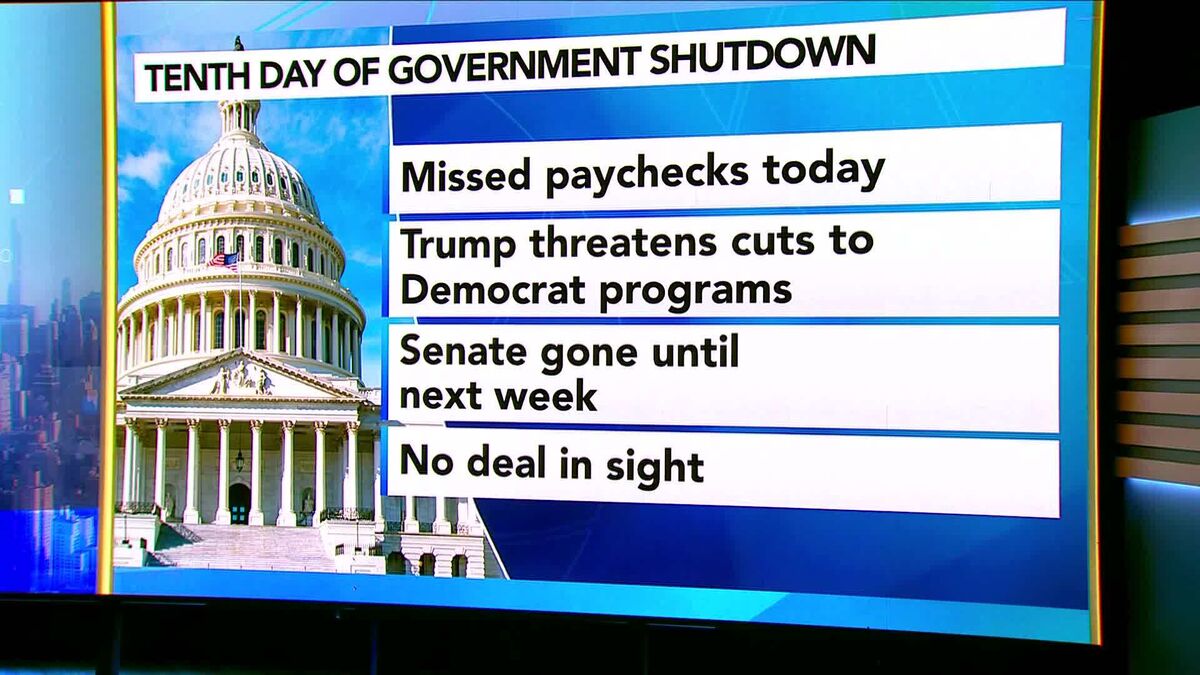

Week Ahead for FX, Bonds: Eyes on U.S. Government Shutdown, Fed Rate-Cut Prospects

NeutralFinancial Markets

This week, financial markets are closely monitoring the potential U.S. government shutdown and the Federal Reserve's hints at possible rate cuts. These developments are crucial as they could significantly impact economic stability and investor confidence. Additionally, inflation data from Europe and monetary policy signals from Asia will also be in focus, making it a pivotal week for global markets.

— Curated by the World Pulse Now AI Editorial System