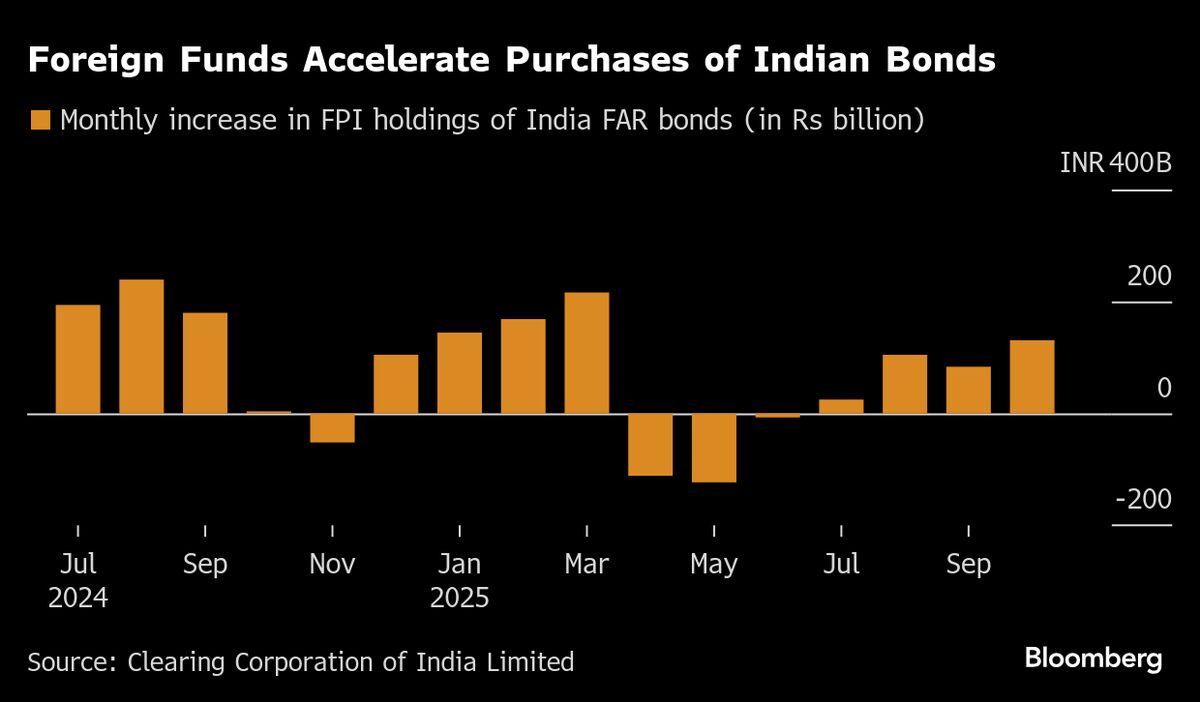

China Factory Activity Gauge Signals Deepening Manufacturing Gloom

NegativeFinancial Markets

China's manufacturing sector is facing increasing challenges, as indicated by a recent gauge that shows a decline in economic momentum. This is significant because it highlights the ongoing struggles of the world's second-largest economy, which could have ripple effects on global markets and trade.

— Curated by the World Pulse Now AI Editorial System