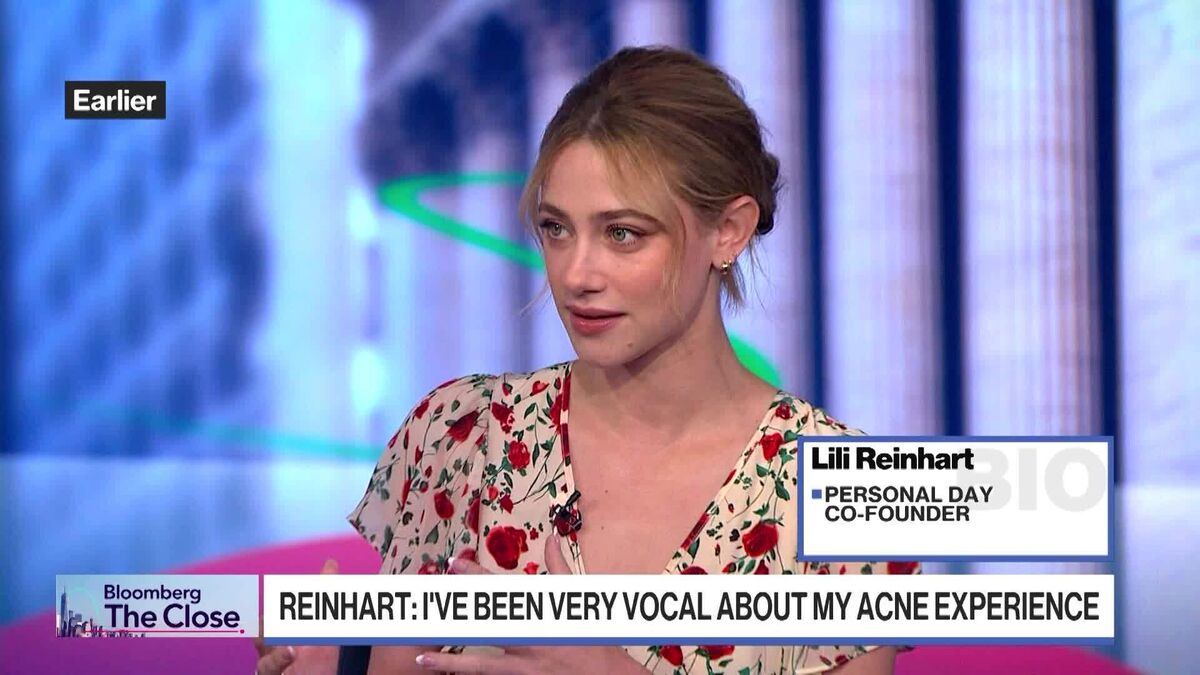

Riverdale's Lili Reinhart on Skincare Brand Personal Day

PositiveFinancial Markets

Lili Reinhart, known for her role in Riverdale, is making waves with her skincare brand Personal Day, emphasizing the importance of accessibility in skincare. She believes that acne is a common struggle and wants her brand to feel approachable, allowing the products to shine on their own. CEO Shelagh Wong echoes this sentiment, highlighting that making skincare accessible is crucial. This initiative not only addresses a widespread issue but also aims to create a supportive community around skincare.

— Curated by the World Pulse Now AI Editorial System