Intel shares surge 30% as Nvidia announces $5 billion investment in America’s one-time chips champion

PositiveFinancial Markets

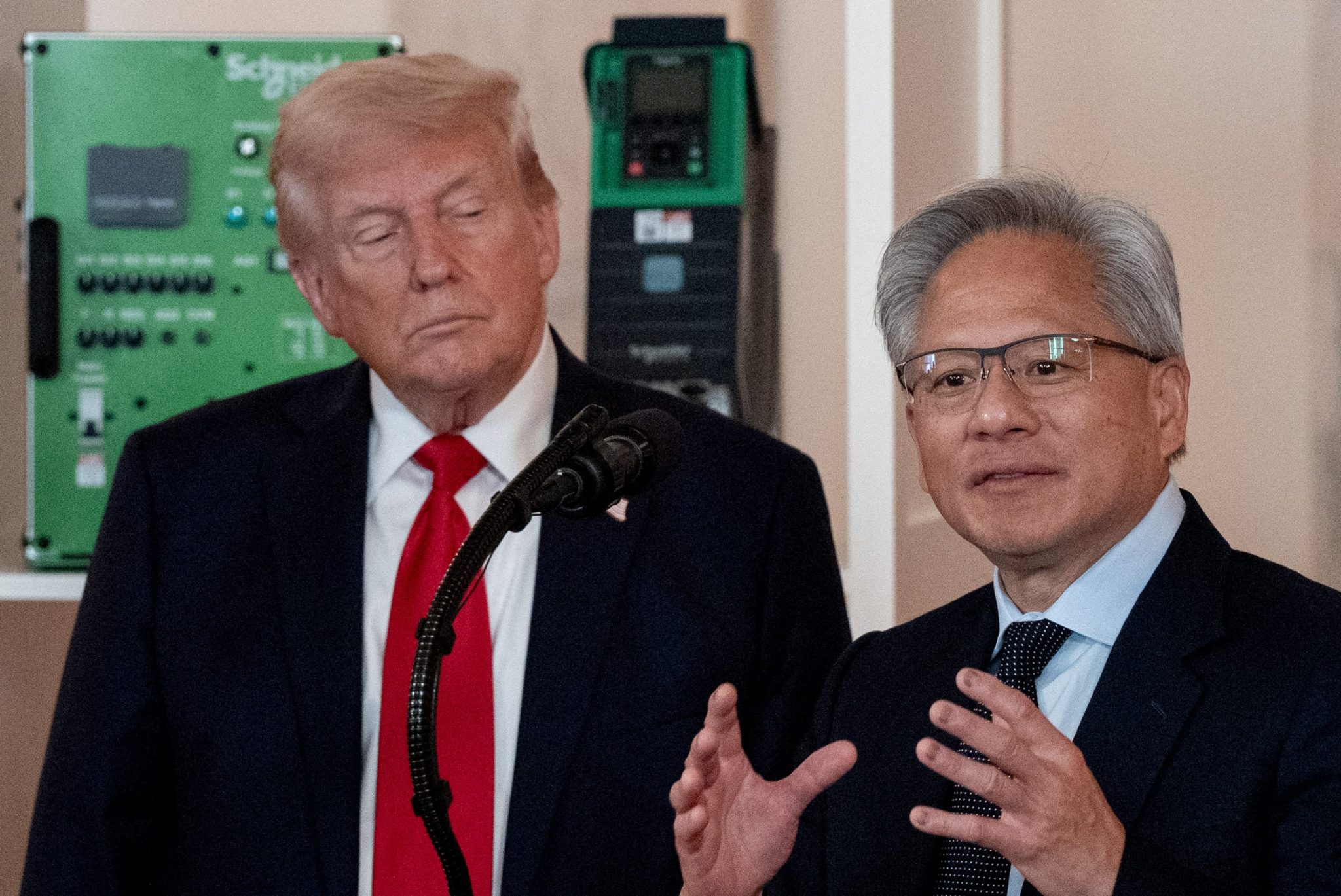

Intel's shares have surged by 30% following Nvidia's announcement of a $5 billion investment in the company, which is being hailed as a historic collaboration by Nvidia CEO Jensen Huang. This partnership is significant as it highlights the growing importance of AI in driving innovation and economic growth, marking a pivotal moment for Intel as it seeks to reclaim its position in the semiconductor industry.

— Curated by the World Pulse Now AI Editorial System