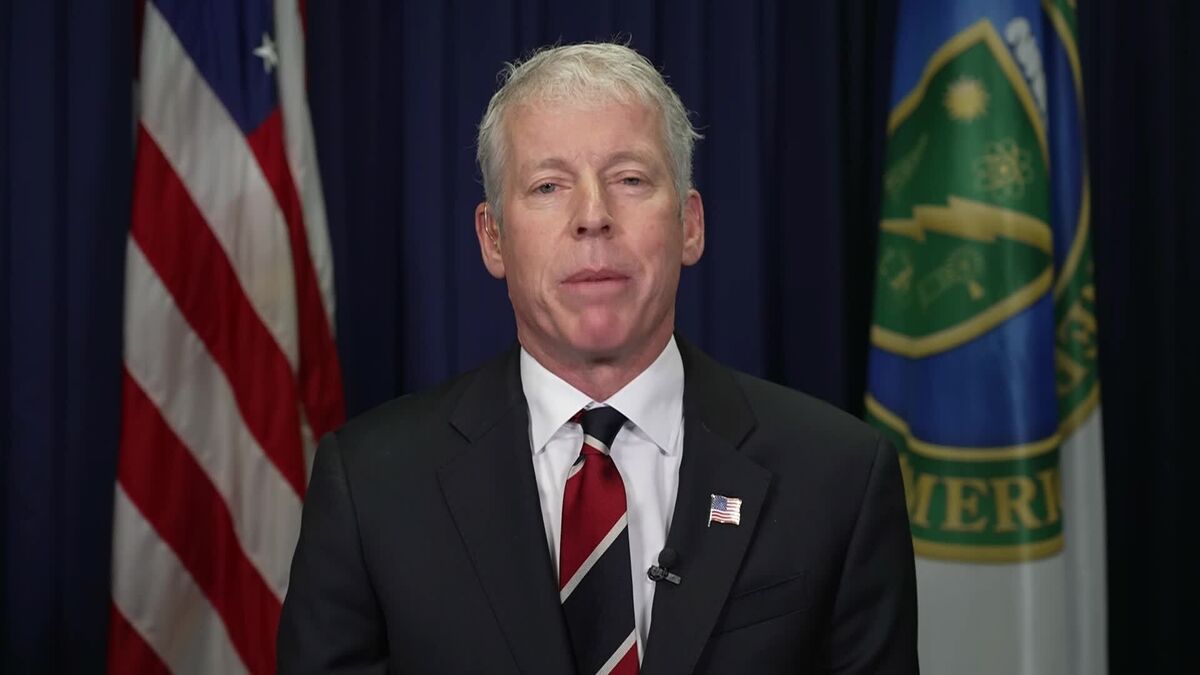

Nuclear Weapons Agency to Begin Furloughs, US Energy Secretary Warns

NegativeFinancial Markets

The US is facing a critical situation as the Nuclear Weapons Agency may have to furlough workers due to the ongoing government shutdown. Energy Secretary Chris Wright highlighted that if the shutdown persists, they won't be able to pay employees starting as early as Friday. This is significant because it jeopardizes the maintenance and design of the nation's nuclear arsenal, raising concerns about national security and the implications of a prolonged shutdown.

— Curated by the World Pulse Now AI Editorial System