Stock Pullback Has Investors Debating How Deep Selloff Will Go

NegativeFinancial Markets

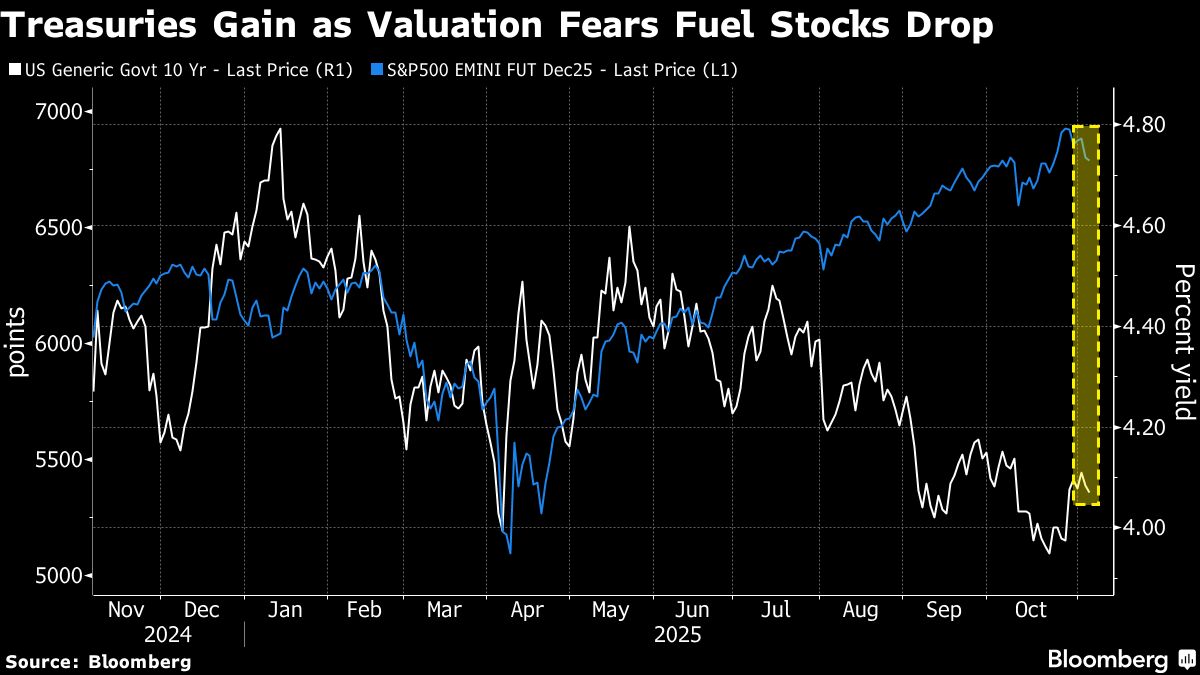

The recent decline in US stocks has investors worried about the potential end of the bull run that began in April. Concerns over high tech valuations, limited market breadth, and ongoing economic uncertainty are fueling debates about how deep the selloff might go.

— Curated by the World Pulse Now AI Editorial System