Fed’s Miran Sees Neutral ‘Quite a Ways Below’ Current Policy

NeutralFinancial Markets

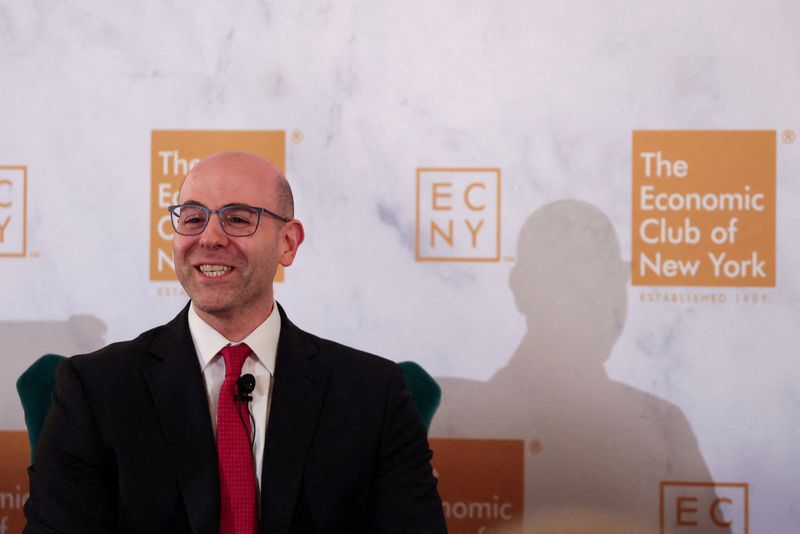

Federal Reserve Governor Stephen Miran recently discussed his perspective on monetary policy, advocating for a more aggressive rate cut of 50 basis points during the last FOMC meeting. He elaborated on the conditions that might prompt another significant cut in December, emphasizing the importance of alternative data and the interplay between fiscal conditions and monetary policy. This discussion is crucial as it highlights the Fed's approach to navigating economic challenges and its potential impact on financial markets.

— Curated by the World Pulse Now AI Editorial System