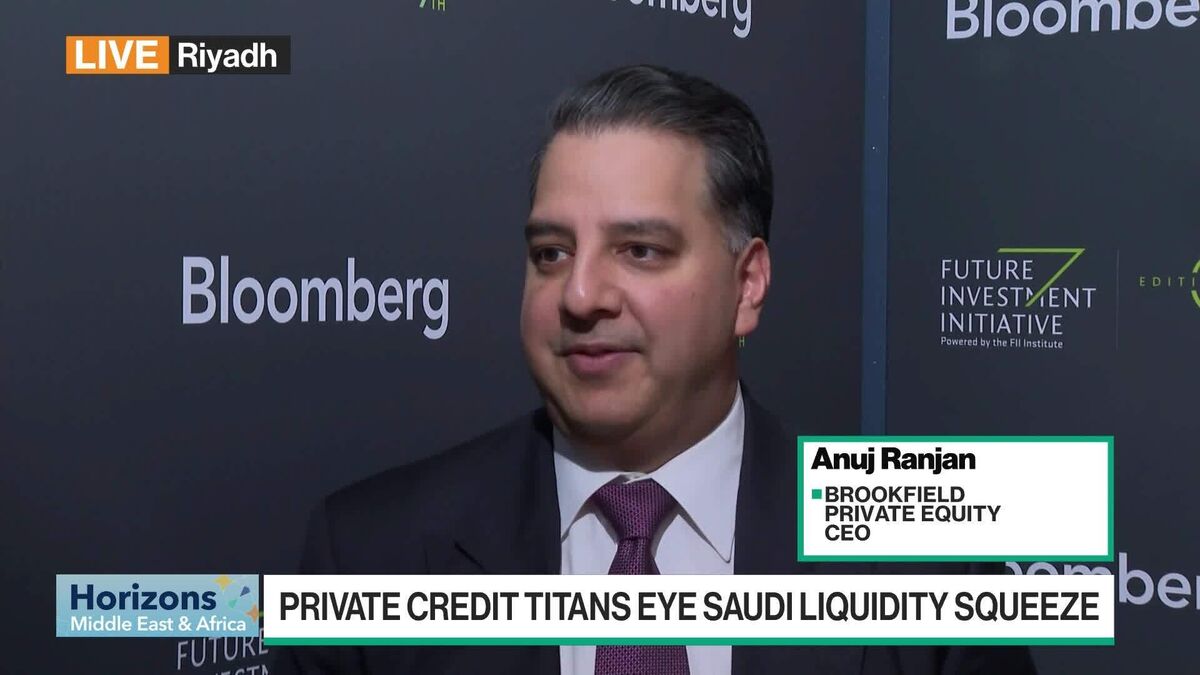

Private Credit Enters the Equity Business as Borrowers Struggle

NeutralFinancial Markets

Private credit firms, traditionally focused on lending, are now venturing into equity as borrowers face increasing financial challenges. This shift is significant as it reflects the evolving landscape of finance, where lenders are adapting their strategies to mitigate losses by converting debt into equity stakes. This trend could reshape the dynamics between borrowers and lenders, highlighting the need for innovative solutions in a tightening economic environment.

— Curated by the World Pulse Now AI Editorial System