Veteran analyst resets Big Tech ‘buy’ list for rest of 2025

PositiveFinancial Markets

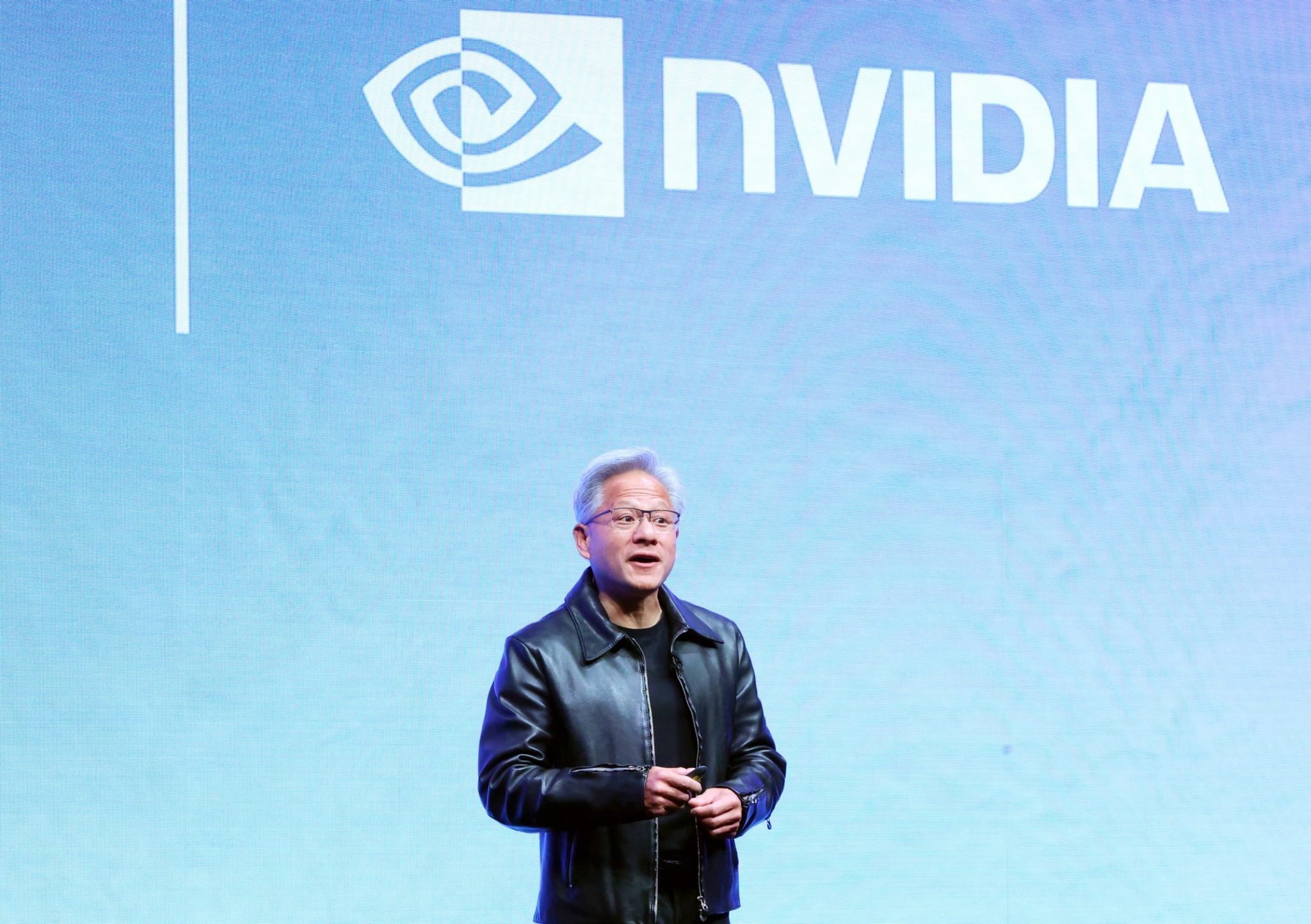

A veteran analyst has updated their 'buy' list for Big Tech, highlighting the resilience of the AI sector despite concerns about a potential bubble. With the S&P 500 up nearly 13% in 2025, this optimism reflects a broader confidence among Wall Street experts that the current tech boom is sustainable. This matters because it signals continued investment opportunities in technology, which could drive economic growth and innovation in the coming years.

— Curated by the World Pulse Now AI Editorial System