Trump to meet Democratic leaders Jeffries, Schumer to discuss government funding

NeutralFinancial Markets

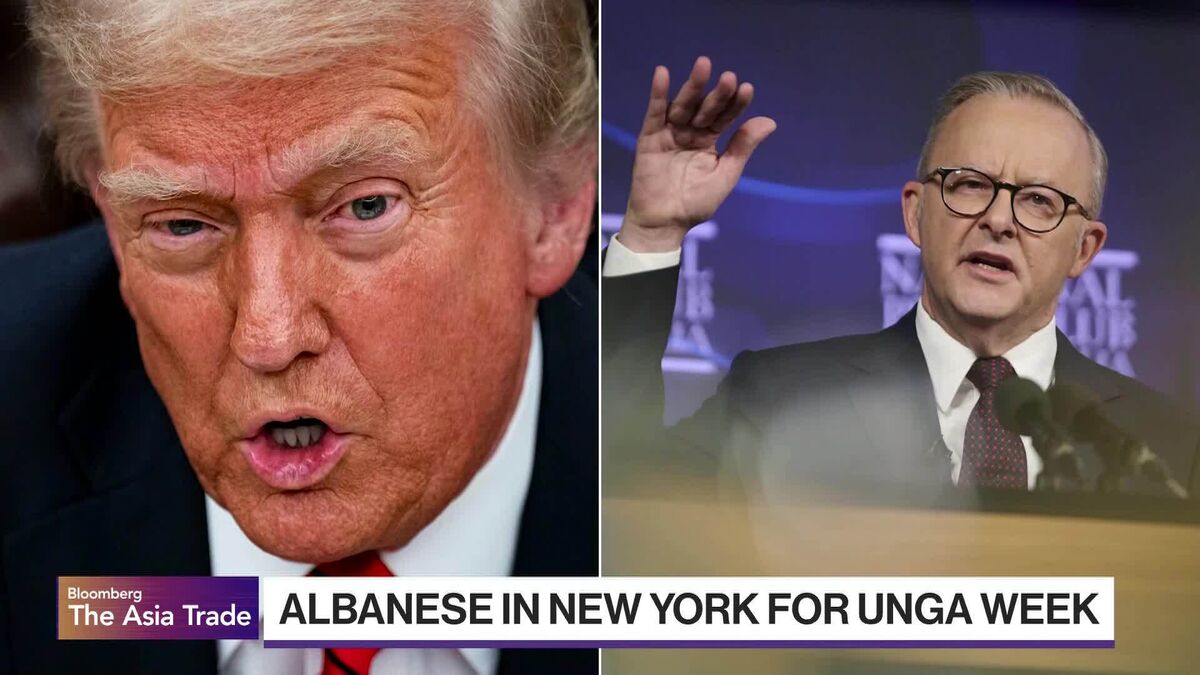

Former President Donald Trump is set to meet with Democratic leaders Hakeem Jeffries and Chuck Schumer to discuss critical government funding issues. This meeting is significant as it highlights the ongoing bipartisan efforts to address budgetary concerns and ensure the government remains operational. With both parties facing pressure from their constituents, this dialogue could pave the way for collaborative solutions.

— Curated by the World Pulse Now AI Editorial System