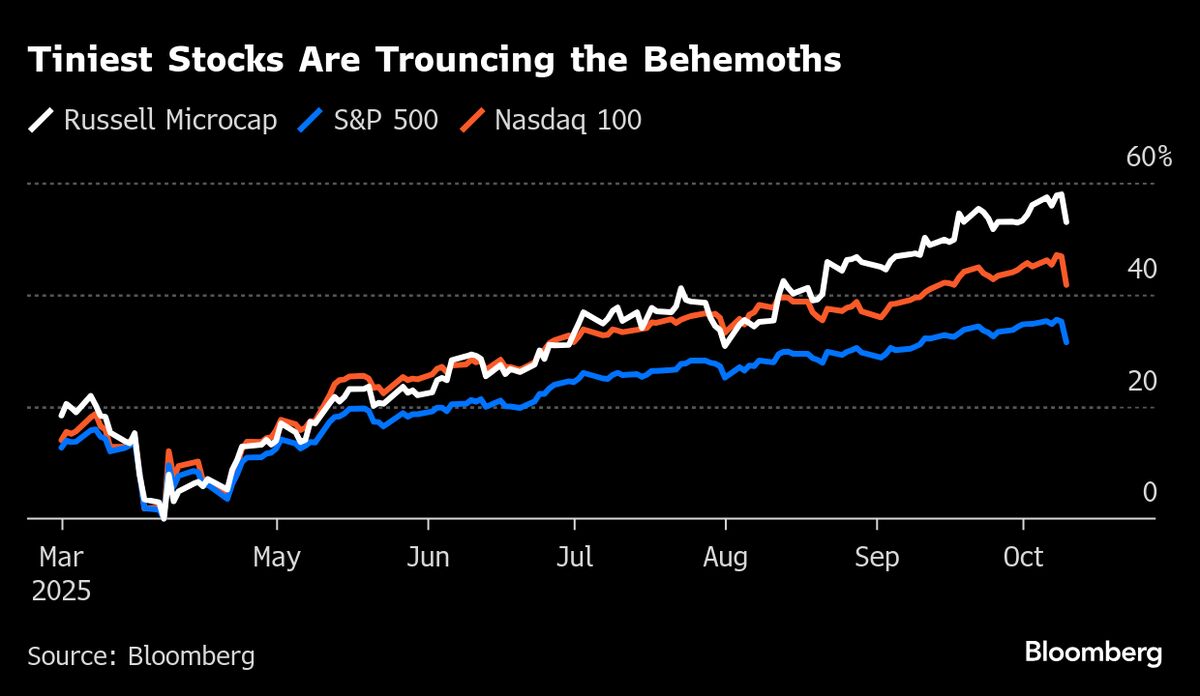

Market-Beating Microcaps Get Rude Awakening From Trade Tensions

NegativeFinancial Markets

Investors in the smallest and most speculative US stocks have recently faced a rude awakening as trade tensions have shaken their months-long market-beating rally. This sudden shift highlights the fragility of market confidence, reminding investors that even the most promising sectors can be vulnerable to external pressures. Understanding these dynamics is crucial for anyone looking to navigate the unpredictable landscape of microcap investments.

— Curated by the World Pulse Now AI Editorial System