Ultrapar announces completion of Hidrovias coastal shipping sale for R$715 million

PositiveFinancial Markets

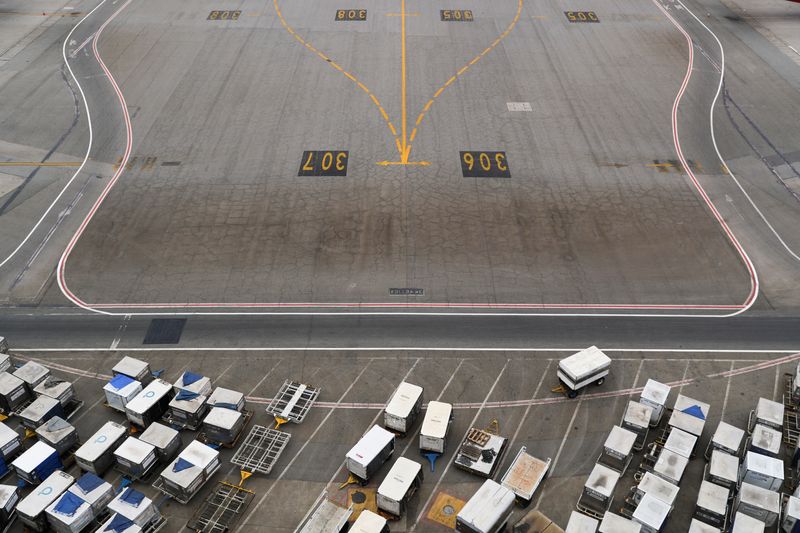

Ultrapar has successfully completed the sale of Hidrovias, a coastal shipping company, for R$715 million. This significant transaction not only strengthens Ultrapar's financial position but also reflects the growing demand for efficient shipping solutions in Brazil. The sale is expected to enhance Ultrapar's focus on its core operations while contributing positively to the Brazilian shipping industry.

— Curated by the World Pulse Now AI Editorial System