Governments are spending billions on their own ‘sovereign’ AI technologies – is it a big waste of money?

NeutralFinancial Markets

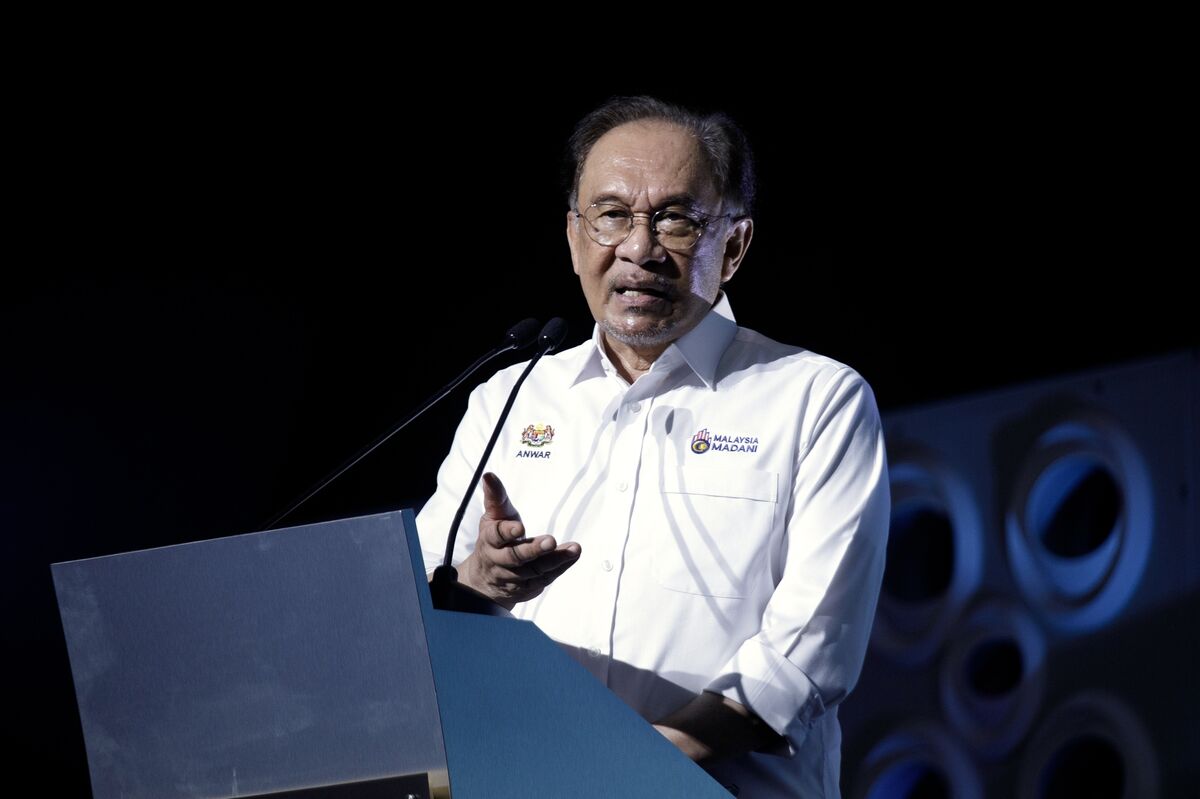

Governments around the world are investing heavily in their own artificial intelligence technologies, raising questions about the effectiveness and necessity of these expenditures. For instance, Singapore has developed an AI model capable of conversing in 11 languages, showcasing its commitment to advancing technology. Meanwhile, Malaysia's ILMUchat aims to provide localized AI solutions. However, the challenge remains for these systems to compete with established tech giants, leading to debates about whether such investments are worthwhile or simply a financial burden.

— Curated by the World Pulse Now AI Editorial System