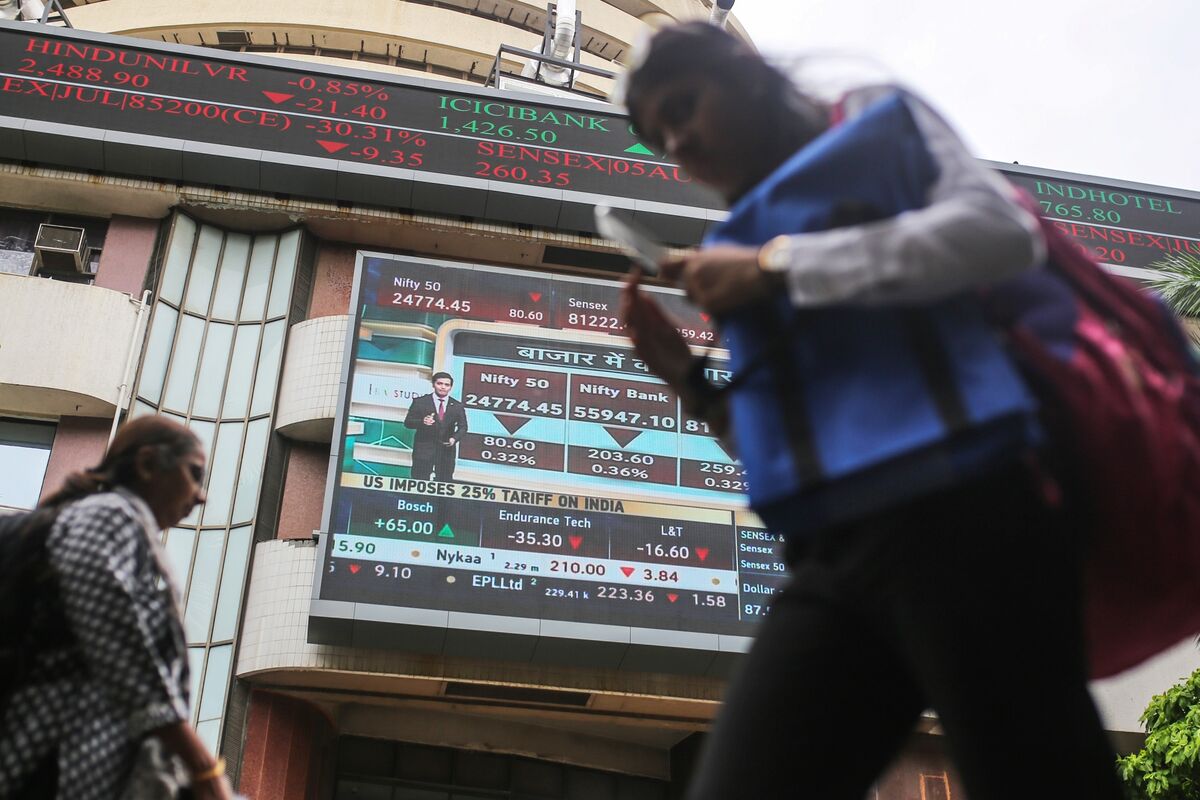

Groww Parent Billionbrains’ IPO Seeks $752 Million in Mumbai IPO

PositiveFinancial Markets

Billionbrains Garage Ventures Ltd., the parent company of Groww, India's largest investment platform, is set to launch an initial public offering (IPO) in Mumbai aiming to raise up to $752 million. This move is significant as it highlights the growing confidence in India's fintech sector and could pave the way for more tech companies to follow suit, potentially boosting the economy and providing investors with new opportunities.

— Curated by the World Pulse Now AI Editorial System