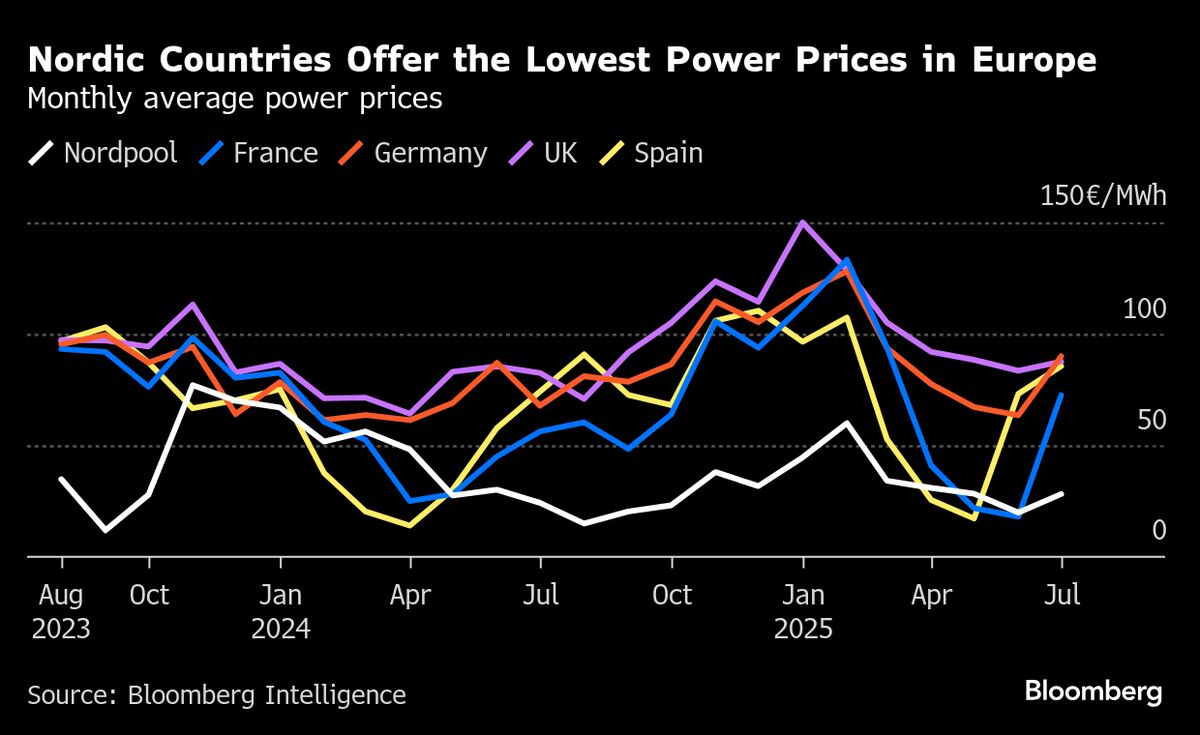

Nordic Data Center Boom Fueled by Low Prices, Empty Land and Cool Weather

PositiveFinancial Markets

The Nordic region is experiencing a significant data center boom, driven by its cool climate and lower energy costs. This trend is attracting major investments from power companies eager to capitalize on the growing demand for data storage and processing. As more mega-projects move north, it not only boosts the local economy but also positions the Nordics as a key player in the European tech landscape.

— Curated by the World Pulse Now AI Editorial System