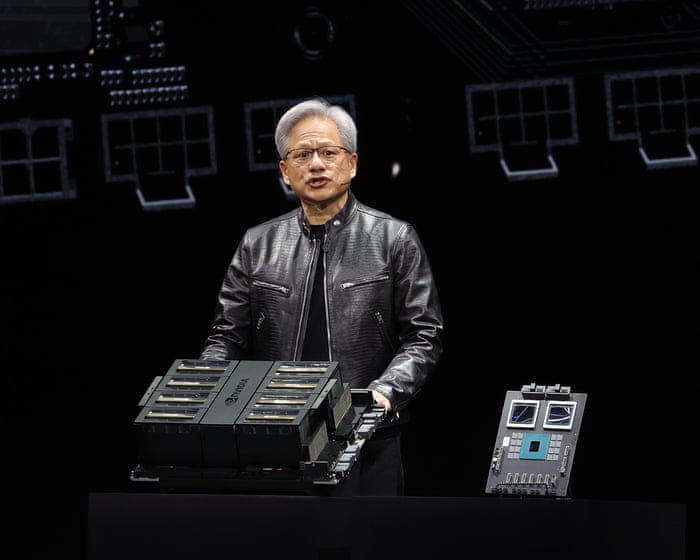

OpenAI and NVIDIA plan $100 billion AI infrastructure partnership

PositiveFinancial Markets

OpenAI and NVIDIA have announced a groundbreaking partnership aimed at investing $100 billion in AI infrastructure. This collaboration is set to revolutionize the AI landscape, enhancing capabilities and accessibility for developers and businesses alike. By pooling their resources and expertise, both companies aim to accelerate advancements in artificial intelligence, which could lead to significant innovations across various sectors. This partnership not only highlights the growing importance of AI but also positions both companies as leaders in the tech industry.

— Curated by the World Pulse Now AI Editorial System