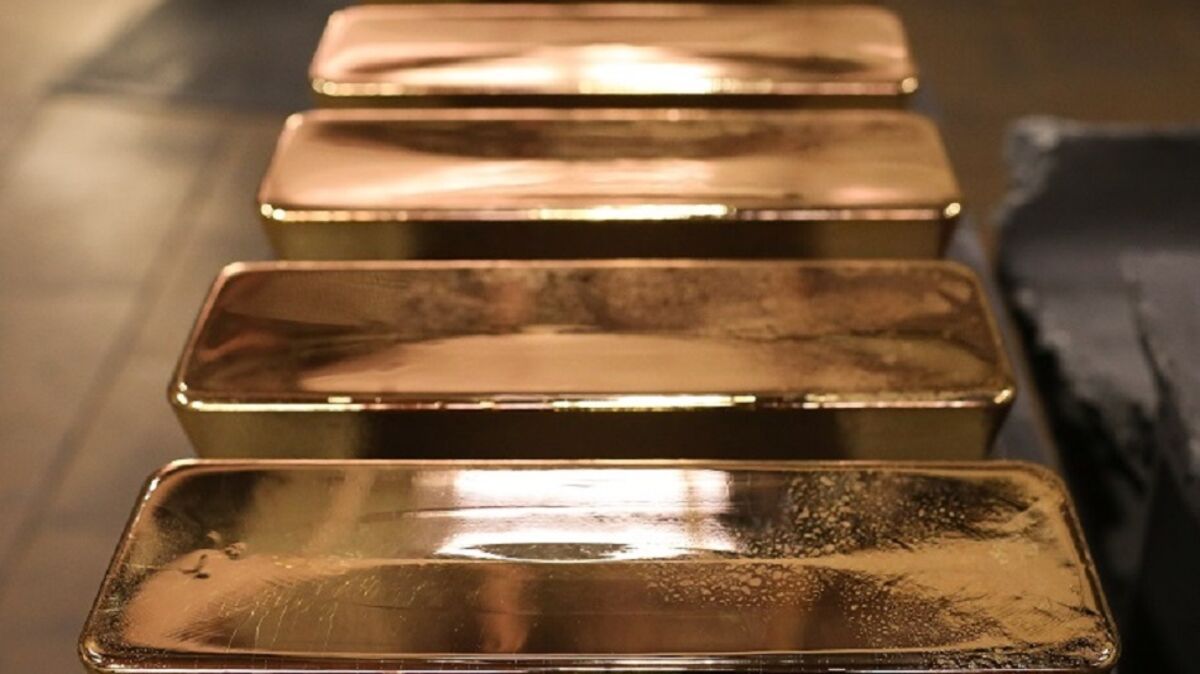

Akobo Minerals reports 21.5 kg gold production for Q3 2025

PositiveFinancial Markets

Akobo Minerals has announced a significant milestone with a gold production of 21.5 kg for the third quarter of 2025. This achievement not only highlights the company's operational efficiency but also reflects positively on the gold market, indicating a potential increase in investor confidence. As gold remains a valuable asset, this production report could attract more attention to Akobo Minerals and its future prospects.

— Curated by the World Pulse Now AI Editorial System