Israel approves Trump’s plan for Gaza ceasefire and hostage release

PositiveFinancial Markets

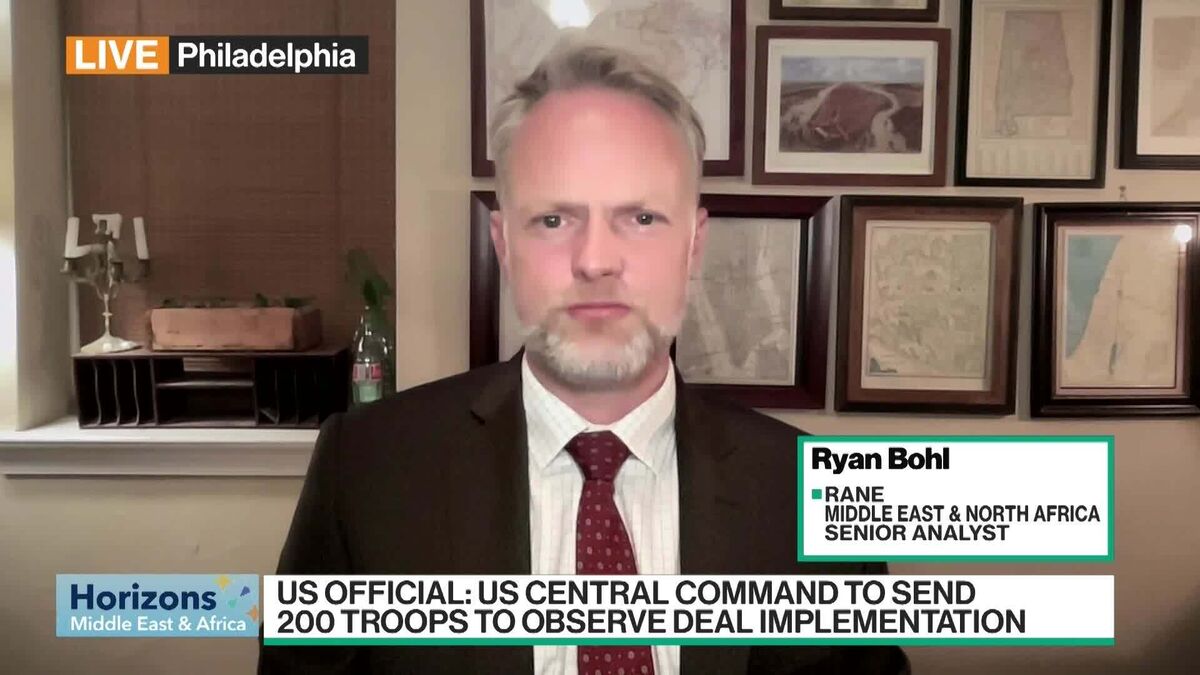

In a significant move towards peace, Israeli Prime Minister Benjamin Netanyahu's cabinet has approved the first phase of President Trump's plan for a ceasefire in Gaza and the release of hostages. This decision marks a hopeful step in addressing the ongoing conflict and could pave the way for further negotiations. The approval reflects a willingness to engage in dialogue and seek resolutions that benefit both sides, highlighting the importance of international cooperation in achieving lasting peace.

— Curated by the World Pulse Now AI Editorial System