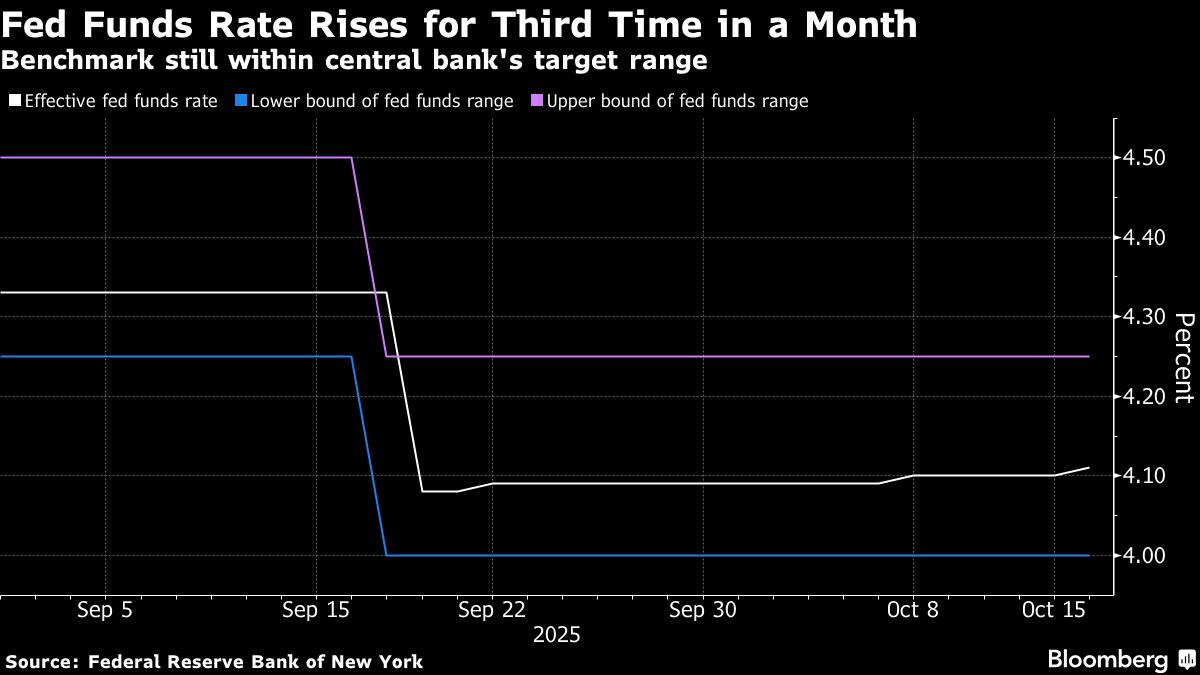

Fed’s Policy Benchmark Rate Rises for Third Time in a Month

NegativeFinancial Markets

The Federal Reserve has raised its effective federal funds rate for the third time this month, indicating ongoing pressures in the funding markets due to its balance-sheet runoff and Treasury auction settlements. This increase is significant as it reflects the Fed's efforts to manage economic stability, but it may also signal tighter financial conditions for borrowers and investors, potentially impacting economic growth.

— Curated by the World Pulse Now AI Editorial System