Tariff Uncertainty Reigns Amid Supreme Court Skepticism

NegativeFinancial Markets

Tariff Uncertainty Reigns Amid Supreme Court Skepticism

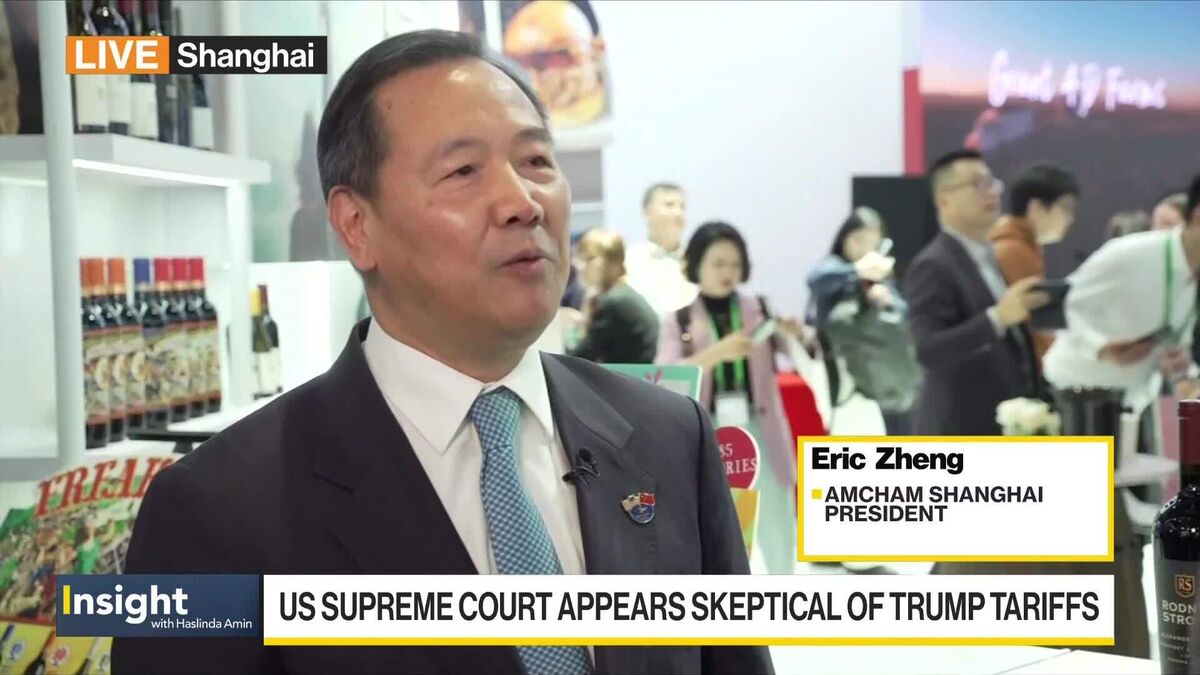

President Donald Trump's authority to impose tariffs is under scrutiny as the Supreme Court raises doubts about his broad powers. This is significant because it could impact trade policies and economic relations, affecting businesses and consumers alike. The outcome of this case may reshape how tariffs are implemented in the future.

— via World Pulse Now AI Editorial System