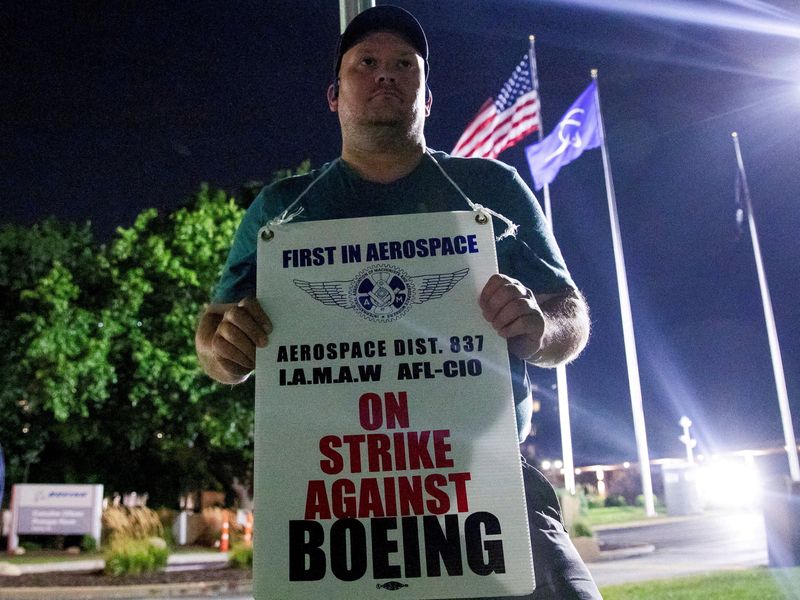

Boeing’s striking union files unfair labor practice charge against planemaker

NegativeFinancial Markets

Boeing is facing a significant challenge as its striking union has filed an unfair labor practice charge against the company. This move highlights ongoing tensions between the planemaker and its workers, who are demanding better conditions and pay. The outcome of this charge could have serious implications for Boeing's operations and its relationship with employees, making it a crucial moment in labor relations within the aerospace industry.

— Curated by the World Pulse Now AI Editorial System