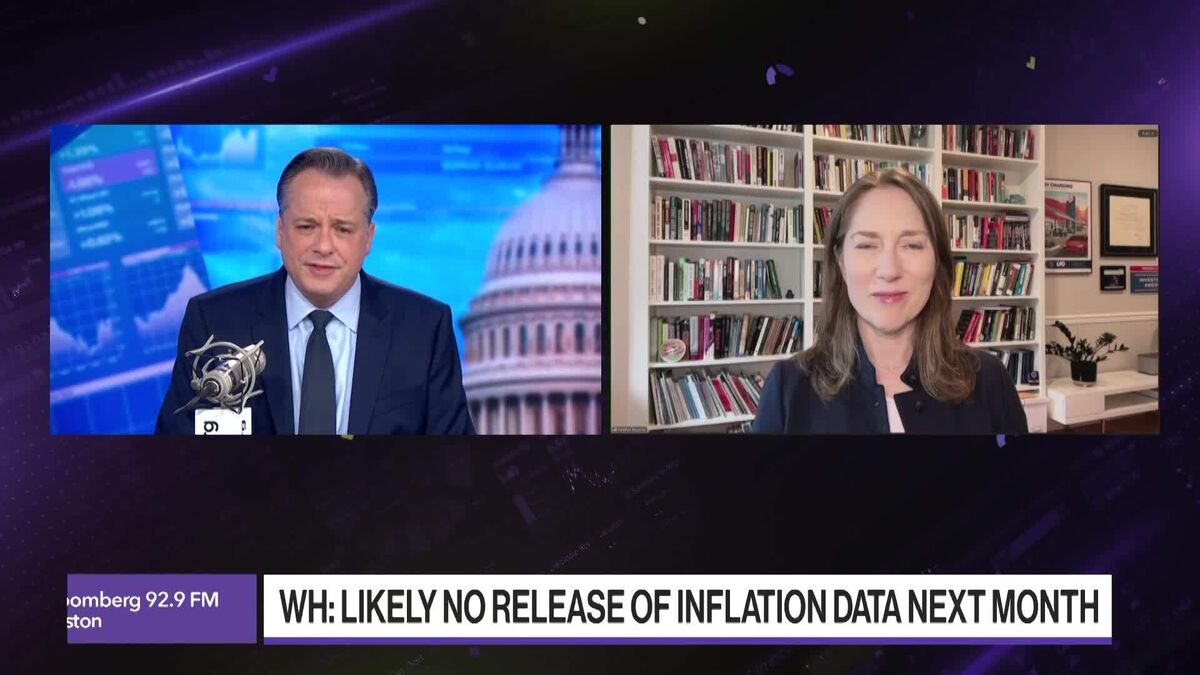

Consumer Sentiment Falls, US May Have No Inflation Data for October

NegativeFinancial Markets

Consumer sentiment in the US has dropped to its lowest point in five months, raising concerns about high prices affecting family budgets. While job market expectations remain stable, they are still viewed unfavorably. Adding to the uncertainty, the White House has indicated that there may be no inflation data released for October due to the ongoing government shutdown. This situation is significant as it reflects the economic challenges facing consumers and could influence future policy decisions.

— Curated by the World Pulse Now AI Editorial System