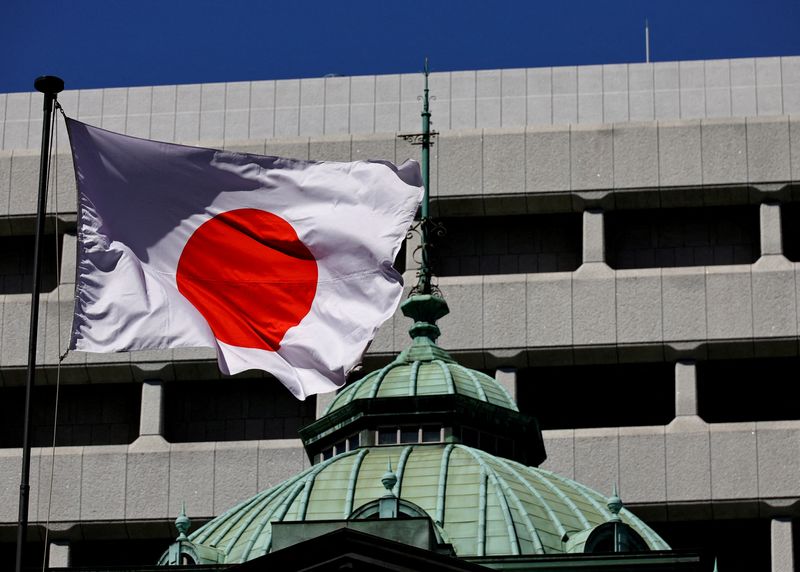

Top Japan Local Bank Ready to Boost JGB Buying When BOJ Pivots

PositiveFinancial Markets

Bank of Yokohama Ltd., the largest regional lender in Japan, is gearing up to increase its purchases of Japanese Government Bonds (JGB) as the Bank of Japan (BOJ) approaches a pivotal moment in its interest rate policy. This move is significant as it reflects confidence in the domestic debt market and could signal a shift in economic conditions, potentially benefiting investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System