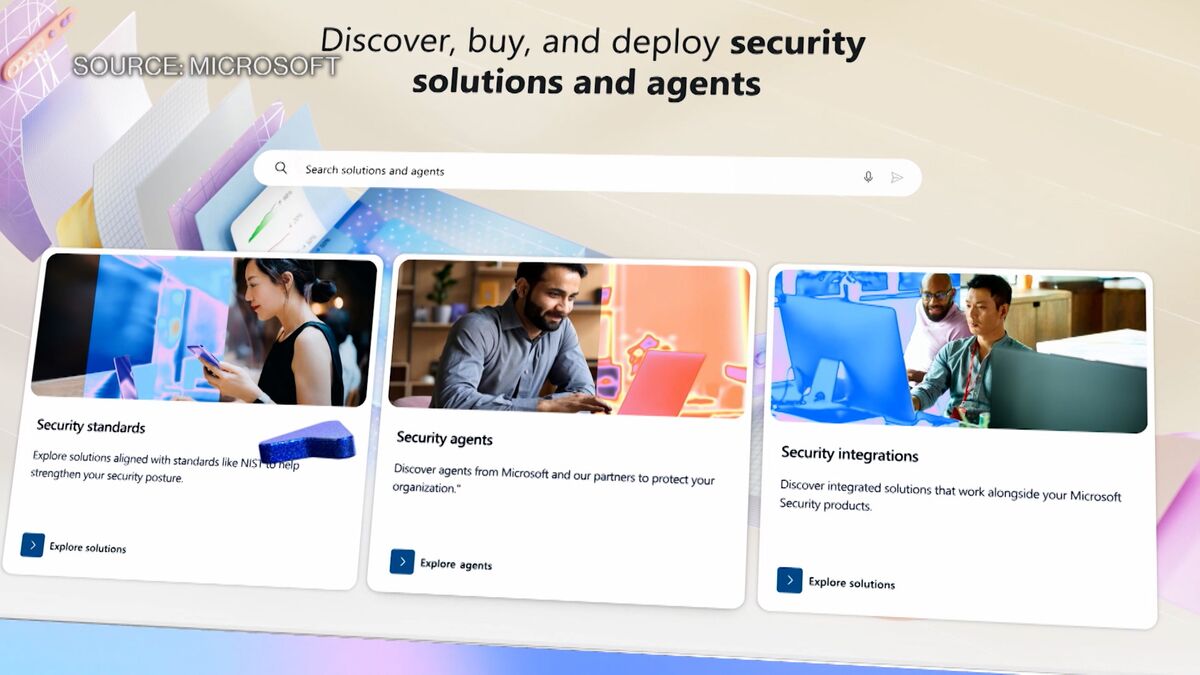

CyberArk joins Microsoft Security Store to streamline security solutions

PositiveFinancial Markets

CyberArk has partnered with Microsoft to join the Microsoft Security Store, enhancing its security solutions for businesses. This collaboration is significant as it allows CyberArk to leverage Microsoft's extensive platform, providing customers with streamlined access to advanced security tools. By integrating their offerings, both companies aim to strengthen cybersecurity measures, making it easier for organizations to protect their sensitive data in an increasingly digital world.

— Curated by the World Pulse Now AI Editorial System