Bitcoin Struggles to Find Momentum After Historic Wipeout

NegativeFinancial Markets

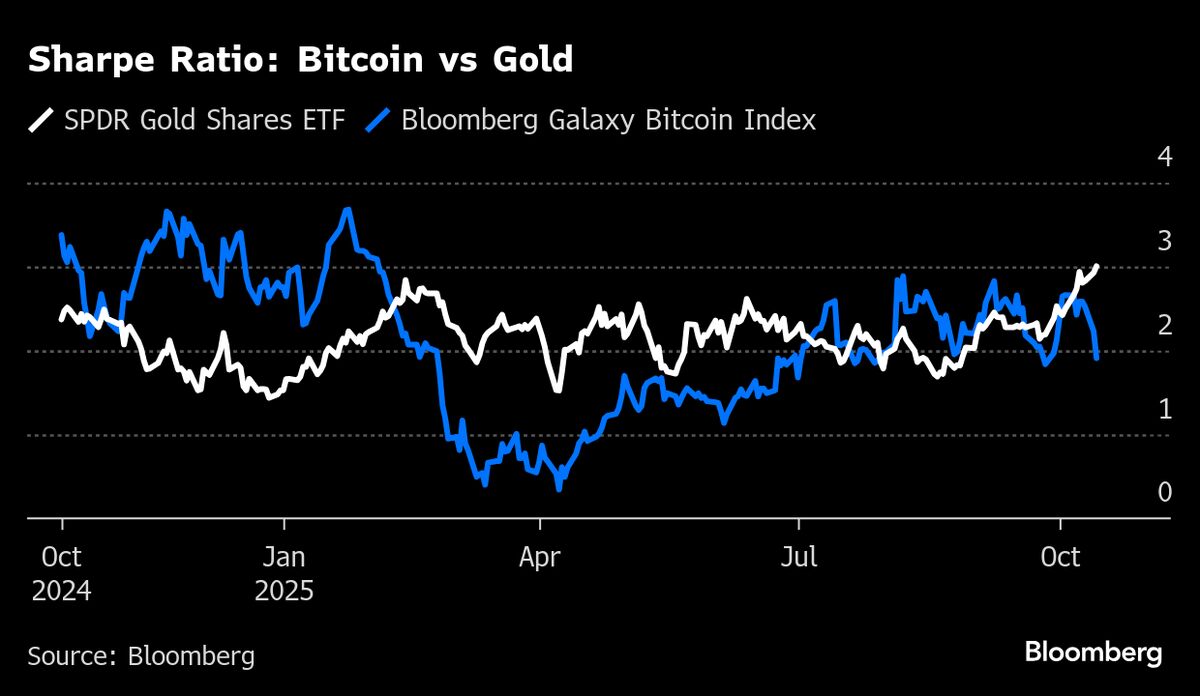

Bitcoin is facing significant challenges as it struggles to regain momentum following a week-long decline that wiped out hundreds of billions in value. This downturn raises concerns about its reliability as a safe haven asset, highlighting the volatility and risks associated with cryptocurrency investments.

— Curated by the World Pulse Now AI Editorial System