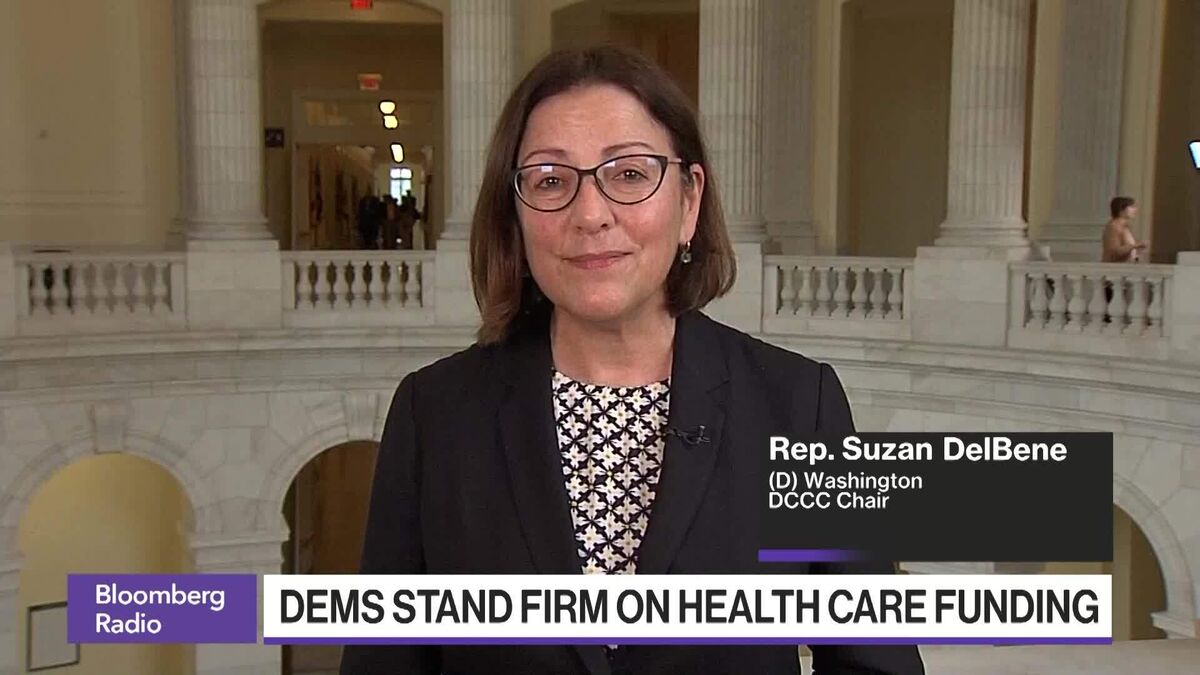

From Utilities To Banks: A Path Toward Less Restrictive Regulation

PositiveFinancial Markets

New Hampshire is making strides in reforming its electricity regulation, and this could serve as a valuable lesson for financial regulators. By expanding a reform initiated in 2018, the state aims to create a more flexible and less restrictive regulatory environment for financial services. This is significant because it could lead to improved efficiency and innovation in the financial sector, benefiting consumers and businesses alike.

— Curated by the World Pulse Now AI Editorial System