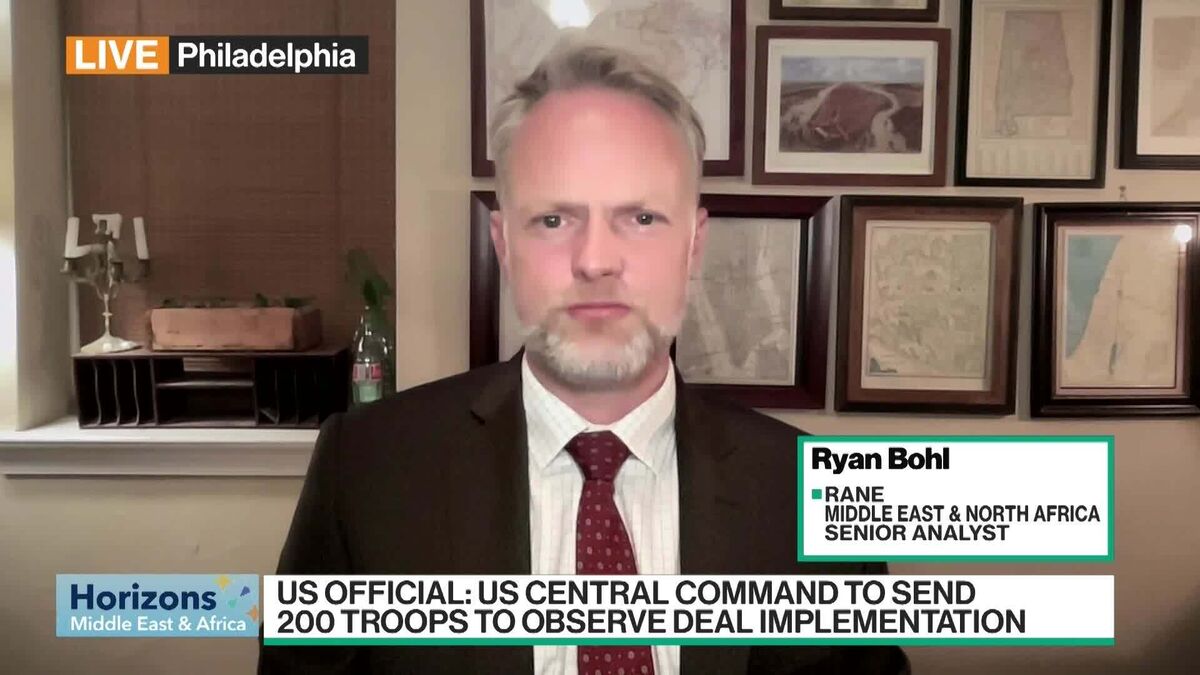

Ailam: US Didn’t Pressure Israel to Sign Ceasefire Deal

PositiveFinancial Markets

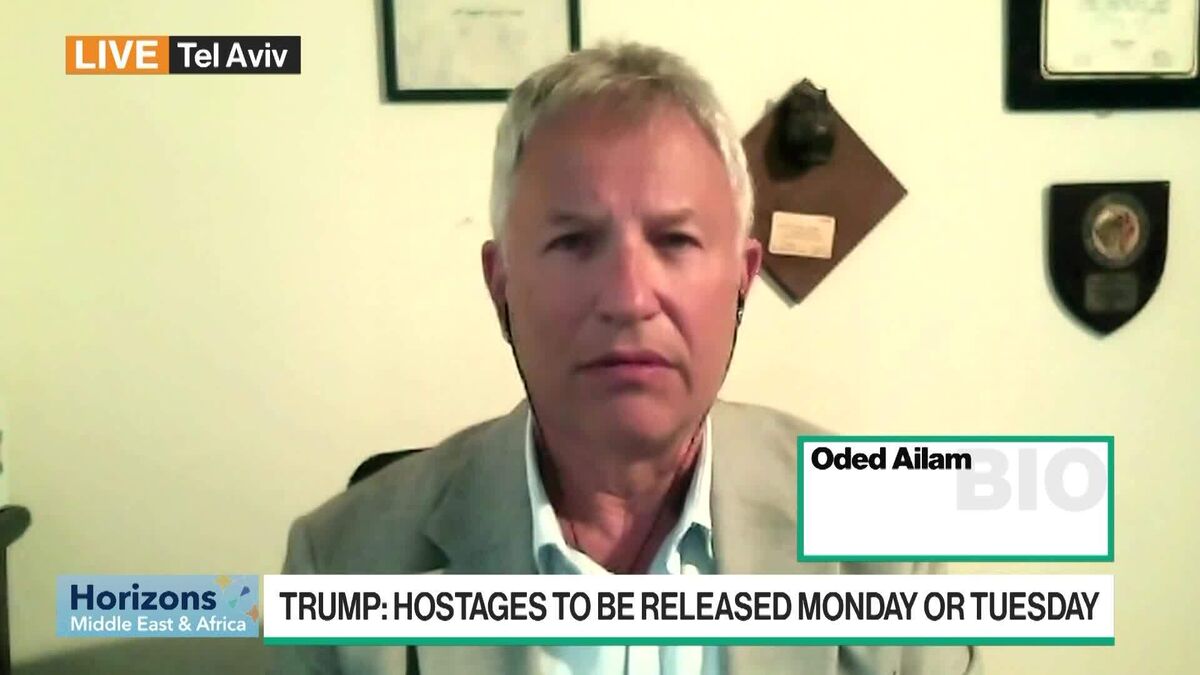

Israel's government has taken a significant step towards peace by approving a deal for Hamas to release hostages in exchange for prisoners. This move, highlighted by former Mossad official Oded Ailam in a recent interview, signals a potential end to the ongoing conflict. The agreement is crucial as it not only addresses humanitarian concerns but also paves the way for a broader peace agreement, making it a pivotal moment for both sides.

— Curated by the World Pulse Now AI Editorial System