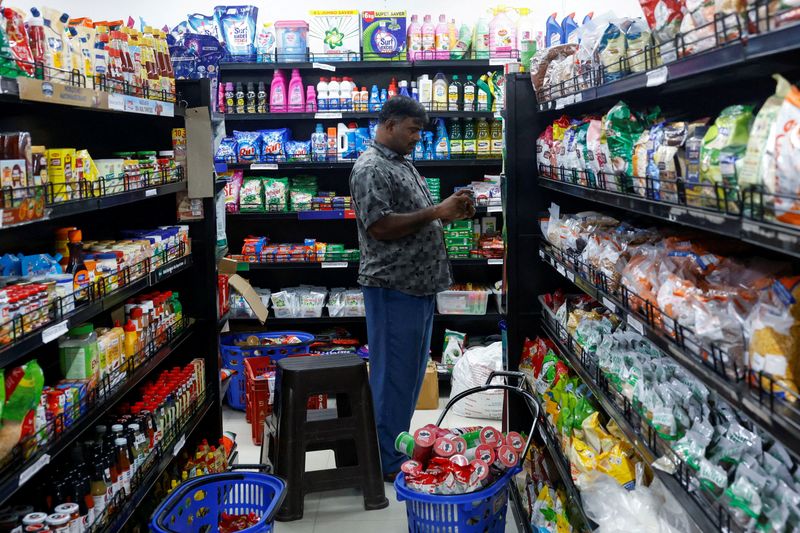

LG India Seen Poised to Rise in Debut After $1.3 Billion IPO

PositiveFinancial Markets

LG Electronics India Ltd. is set for a strong debut in Mumbai after its initial public offering attracted significant investor interest, marking it as the most oversubscribed billion-dollar IPO in 17 years. This surge in demand highlights the confidence investors have in the company's potential and the overall growth of the Indian market, making it a noteworthy event for both the company and the economy.

— Curated by the World Pulse Now AI Editorial System