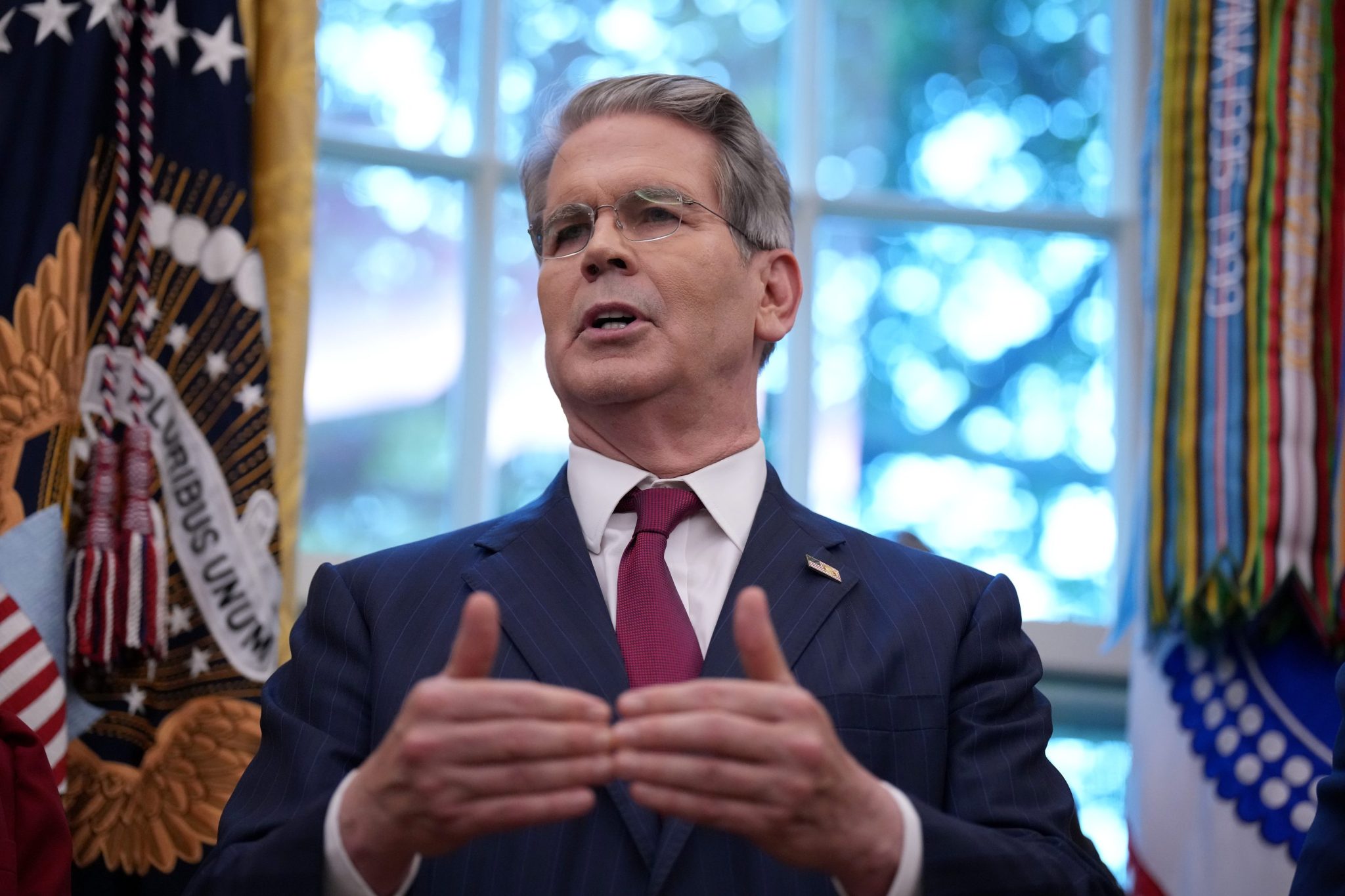

Trump’s tariffs may be bringing in a lot of revenue but they’ve also been a ‘tax on capital, so far,’ top economist says

NeutralFinancial Markets

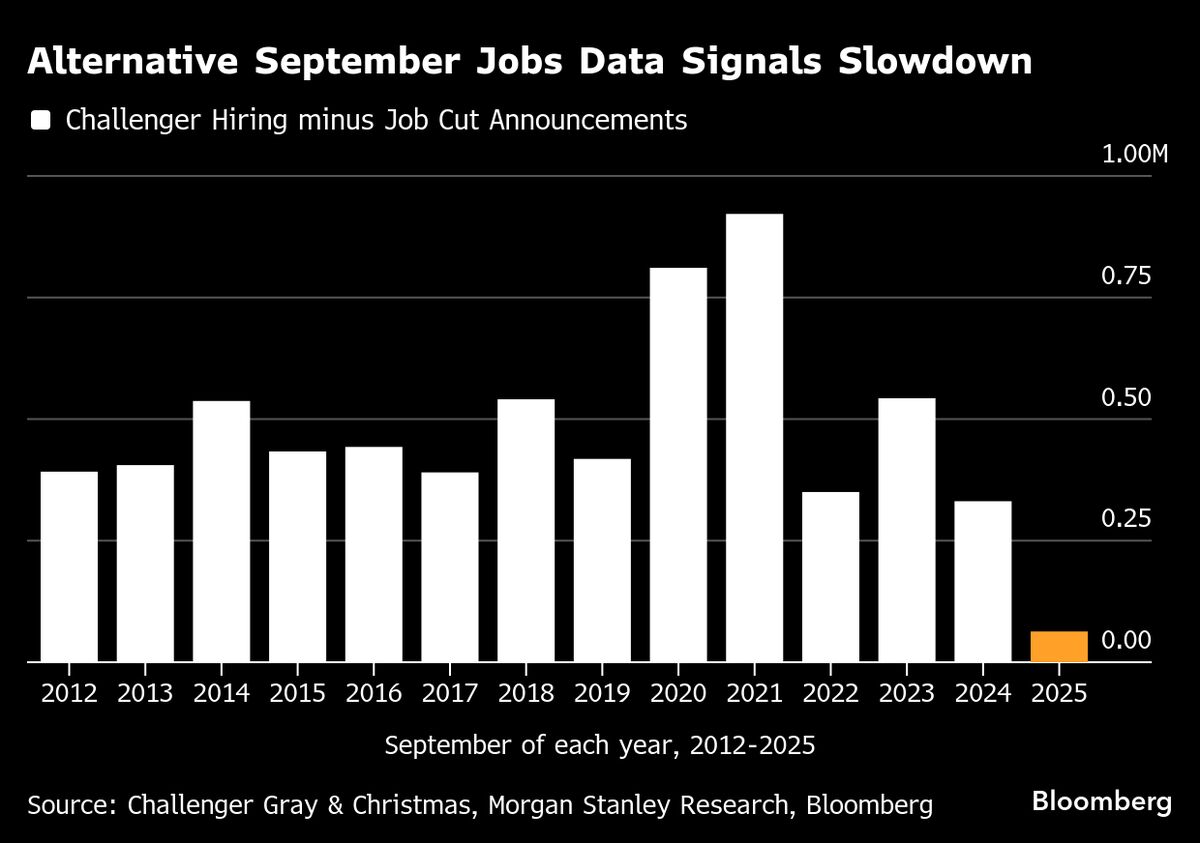

Top economist Michael Gapen from Morgan Stanley highlights that while Trump's tariffs have generated significant revenue, they also represent a 'tax on capital.' This insight sheds light on the evolving economic landscape as we approach 2025, contrasting sharply with the record profit margins seen in 2021 and 2022. Understanding these dynamics is crucial for businesses and investors as they navigate the changing economic environment.

— Curated by the World Pulse Now AI Editorial System