Nigeria Weighs Joining Other Africa Issuers With Eurobond Sale

PositiveFinancial Markets

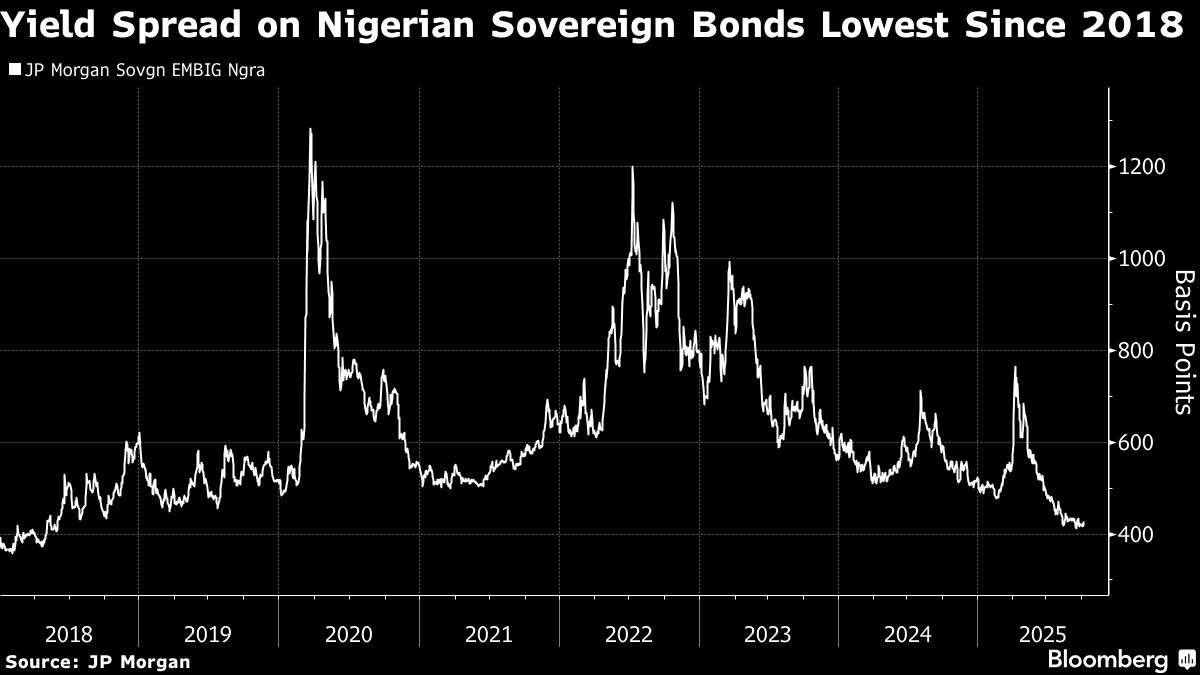

Nigeria is looking to raise up to $2.3 billion through a eurobond sale in the upcoming fourth quarter. This move could align Nigeria with other African nations that are seizing the opportunity to benefit from lower borrowing costs. Such a sale not only helps Nigeria bolster its finances but also signals confidence in the country's economic recovery, making it a significant step for both investors and the nation.

— Curated by the World Pulse Now AI Editorial System