Trump says US has to be careful with China

NeutralFinancial Markets

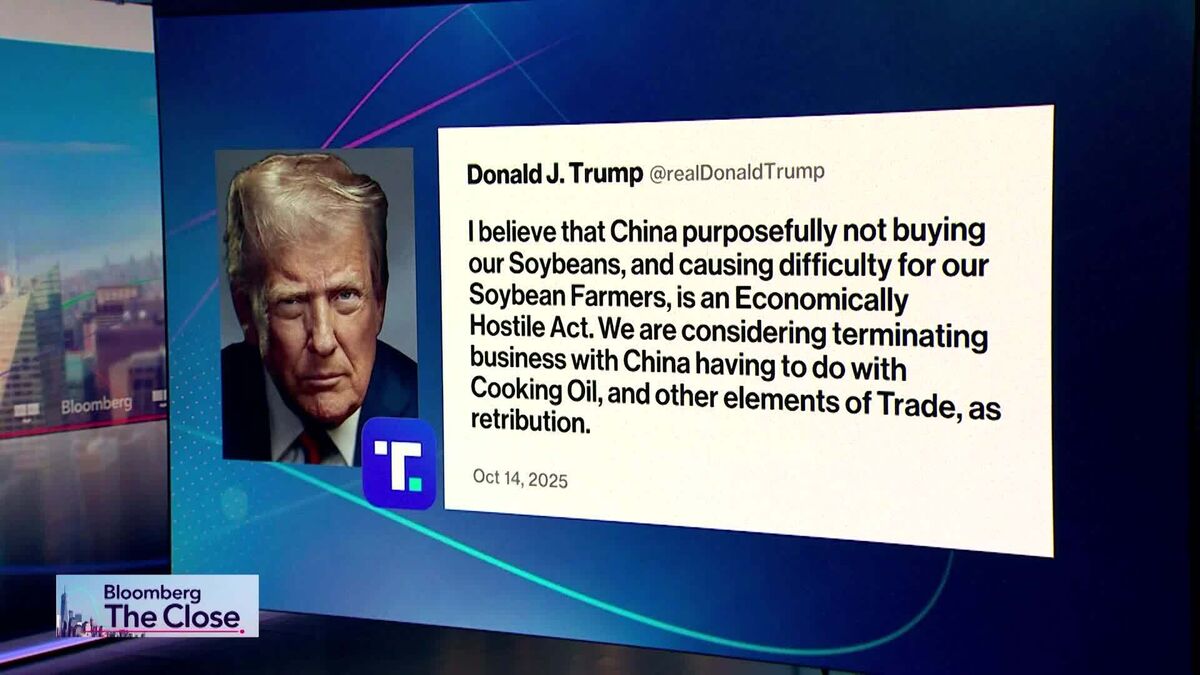

In a recent statement, former President Trump emphasized the need for the United States to approach its relationship with China with caution. This remark highlights ongoing concerns about trade, security, and diplomatic relations between the two nations. As tensions continue to rise, understanding the dynamics of this relationship is crucial for both countries and the global economy.

— Curated by the World Pulse Now AI Editorial System