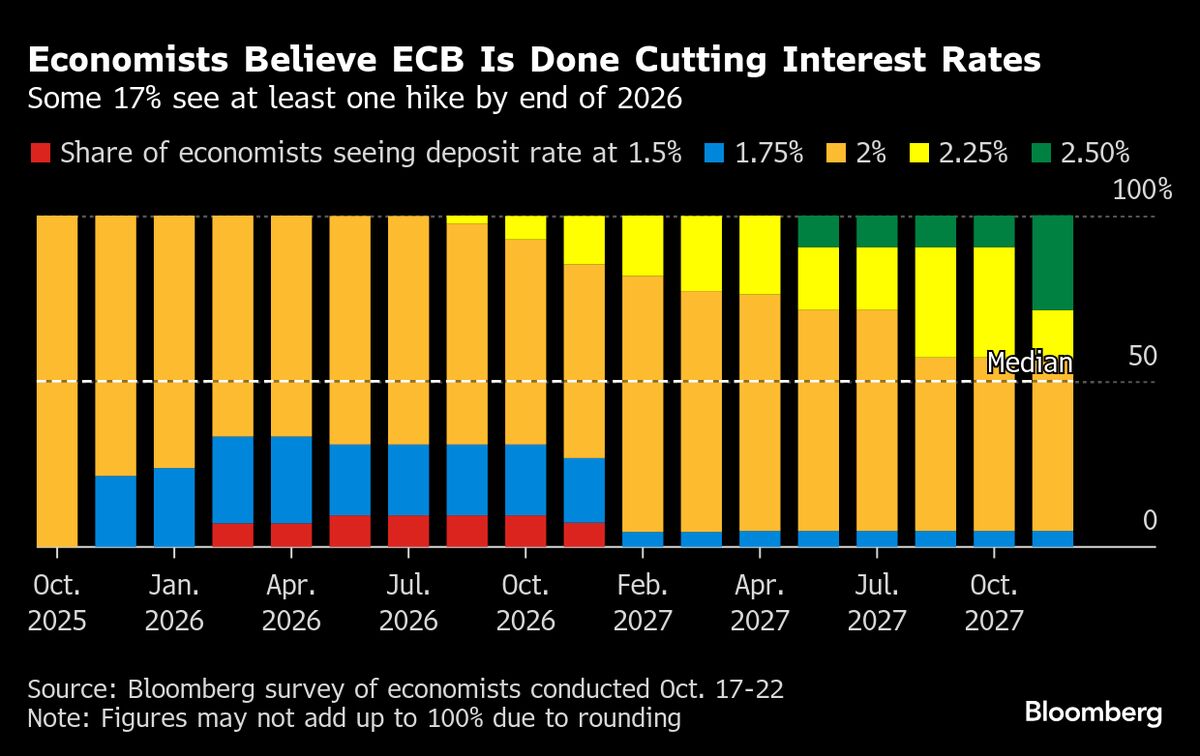

ECB Holds Rates With Inflation Near 2% and Economy Expanding

PositiveFinancial Markets

The European Central Bank has decided to keep interest rates steady for the third consecutive meeting, signaling confidence in the current economic climate. With inflation remaining close to the 2% target and the economy showing signs of growth, this decision reflects a stable financial environment that could encourage further investment and consumer spending. It's a positive indicator for both businesses and consumers as they navigate the economic landscape.

— Curated by the World Pulse Now AI Editorial System