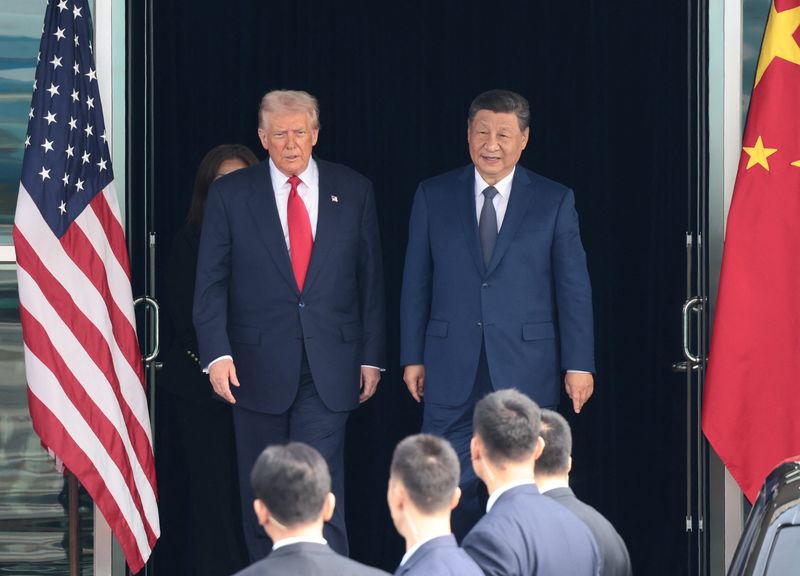

Despite expectations, Trump did not discuss Nvidia’s Blackwell chip with Xi

NeutralFinancial Markets

In a surprising turn of events, former President Donald Trump did not address Nvidia's Blackwell chip during his recent meeting with Chinese President Xi Jinping, despite prior expectations. This omission raises questions about the future of U.S.-China relations, especially in the tech sector, where both countries are vying for dominance. The Blackwell chip is significant for its potential impact on AI and computing, making the lack of discussion noteworthy for industry watchers.

— Curated by the World Pulse Now AI Editorial System