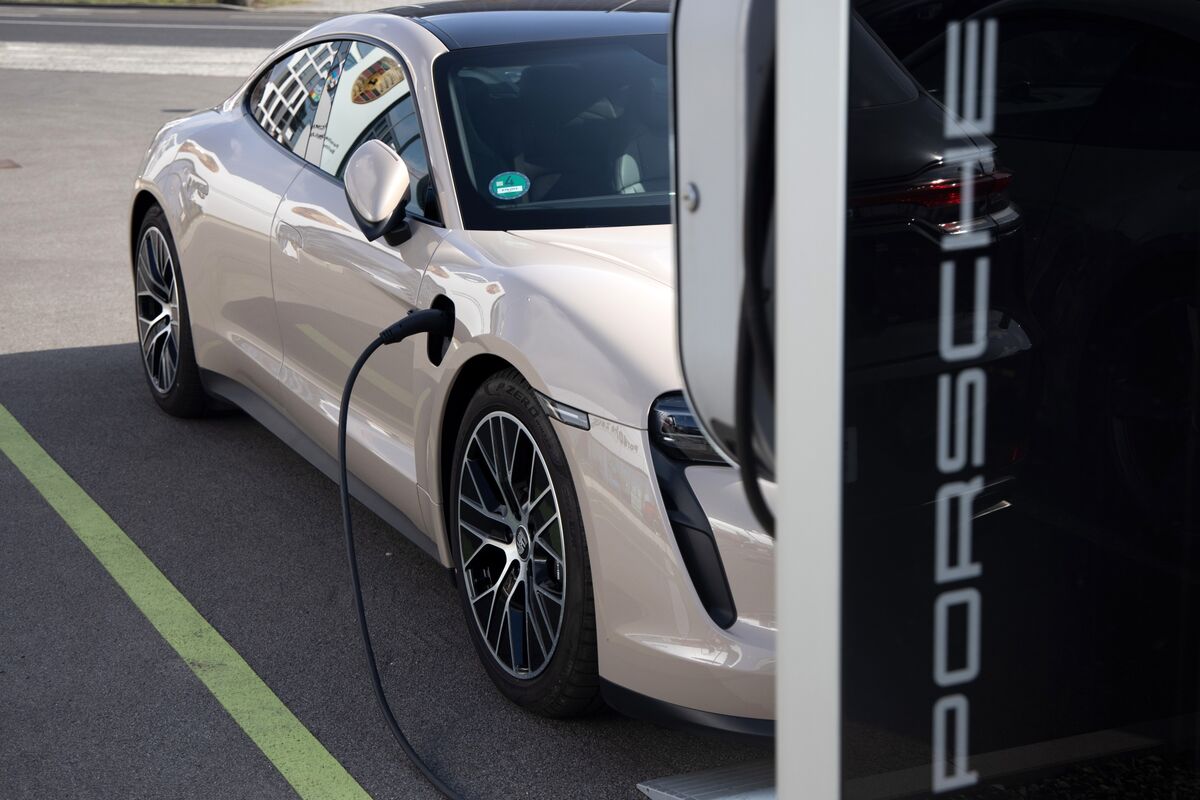

Porsche’s EV Pullback Highlights Cracks in German Auto Empire

NegativeFinancial Markets

Porsche AG's recent decision to scale back its electric vehicle strategy reveals significant challenges within the German automotive industry. This move comes as the luxury car manufacturer faces declining profit margins, which are also impacting its parent company, Volkswagen AG. The shift highlights the broader struggles of traditional automakers to adapt to the electric vehicle market, raising questions about the future of the industry and its ability to compete with emerging players.

— Curated by the World Pulse Now AI Editorial System