Why 2 major asset managers just suspended investments into silver

NegativeFinancial Markets

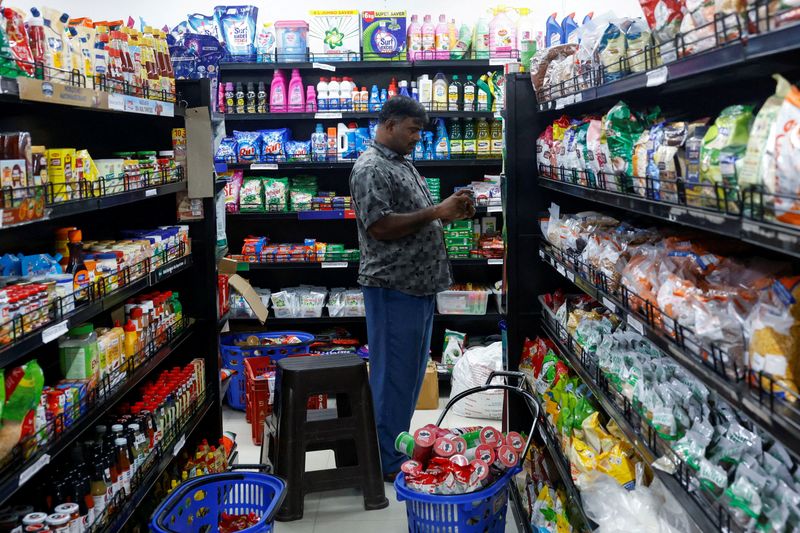

The silver market is facing significant challenges as two major asset managers have suspended their investments due to a combination of strong seasonal demand and a severe supply shortage in India. While silver prices are reaching all-time highs, the erratic behavior of prices and a sharp decline in imports indicate a deeply disrupted market. This situation matters because it highlights the volatility in precious metals and the potential impact on investors and industries reliant on silver.

— Curated by the World Pulse Now AI Editorial System