Oil Holds Sharp Drop With Focus on Gaza Plan and Global Supply

PositiveFinancial Markets

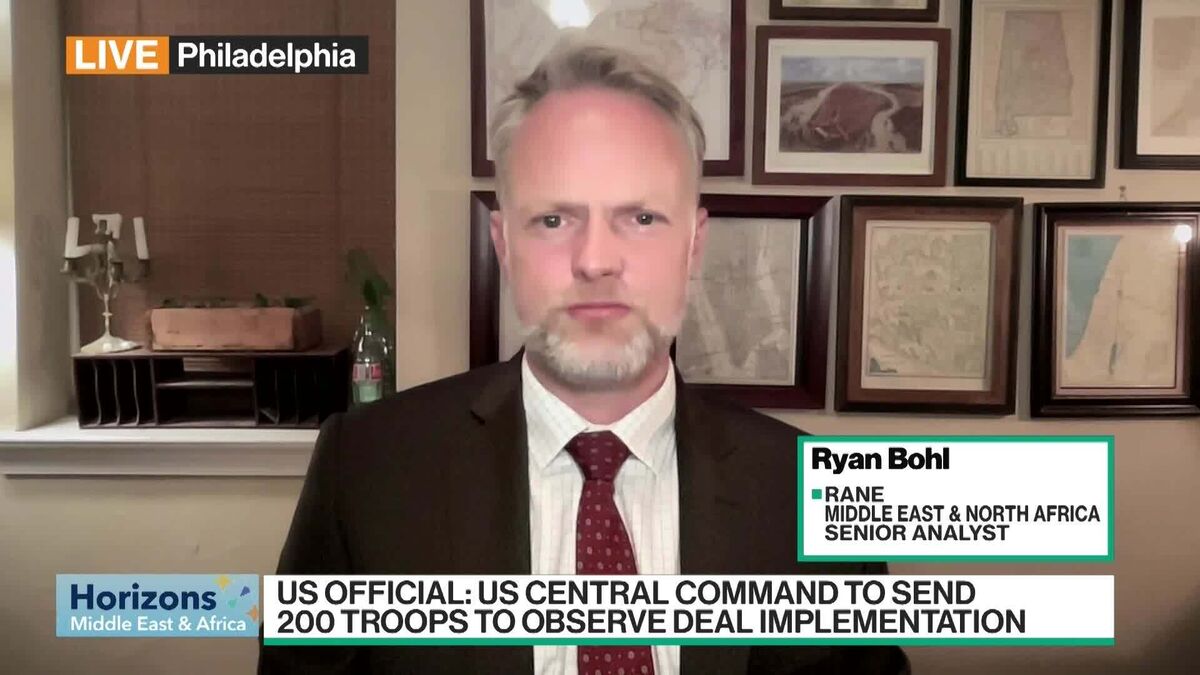

Oil prices experienced a significant drop this week, reflecting cautious optimism regarding the easing of tensions in the Middle East and a more favorable outlook for global supply. This is important as it indicates potential stability in the region, which could lead to more predictable oil prices and economic benefits for countries reliant on oil exports.

— Curated by the World Pulse Now AI Editorial System