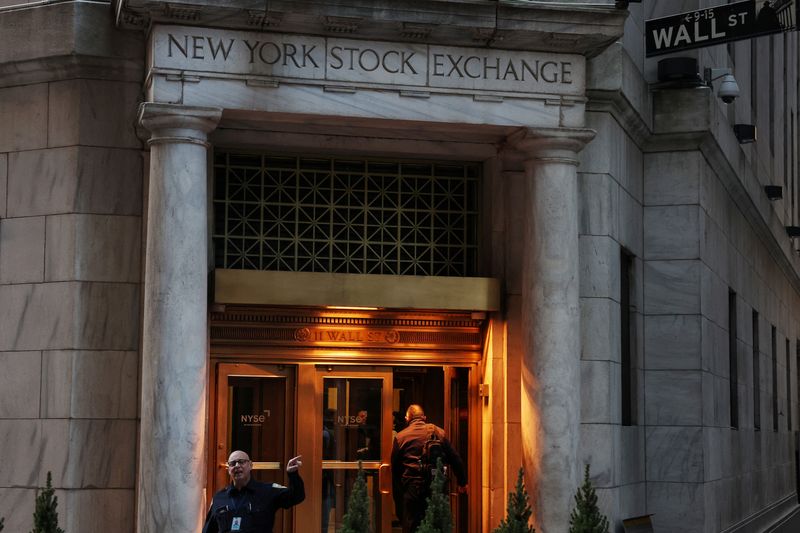

Wall Street indexes finish lower, data raises uncertainty for rate-cut outlook

NegativeFinancial Markets

Wall Street indexes closed lower as recent economic data has created uncertainty regarding the outlook for interest rate cuts. This decline reflects investor concerns about inflation and the potential impact on future monetary policy. Understanding these trends is crucial for investors as they navigate a volatile market.

— via World Pulse Now AI Editorial System