Cathie Wood sells $15.8 million of megacap tech stock

NeutralFinancial Markets

- Cathie Wood's ARK Investment Management has sold $15.8 million worth of megacap tech stock, indicating a strategic shift in its investment approach. This move aligns with ARK's ongoing adjustments to its portfolio, which has included recent sales and acquisitions across various sectors.

- The sale reflects Wood's strategy to optimize her investment holdings, as she continues to navigate the volatile tech market. This decision may influence investor sentiment and highlight ARK's focus on reallocating resources towards emerging technologies and financial services.

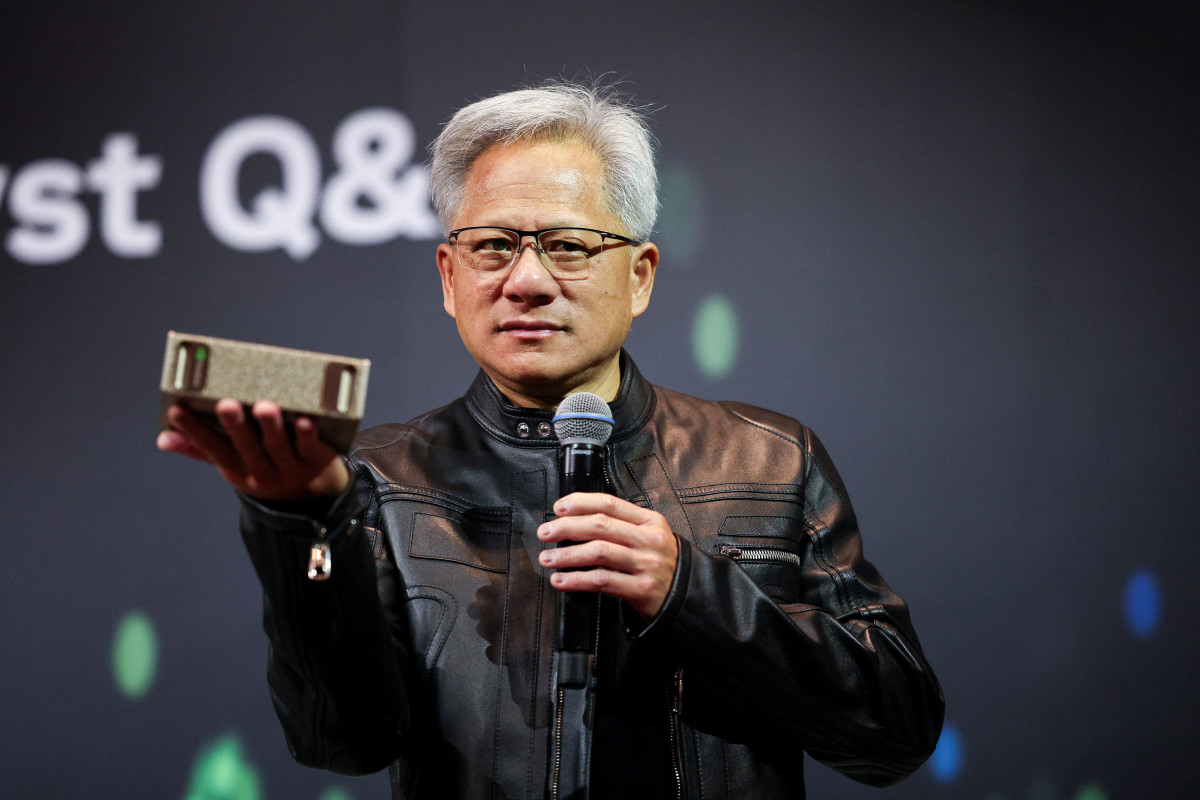

- This development is part of a broader trend where ARK has been actively buying and selling stocks, including significant investments in companies like Nvidia and Roblox. The contrasting moves of selling established tech stocks while investing in newer technologies suggest a calculated approach to capitalize on high-growth opportunities in the evolving market landscape.

— via World Pulse Now AI Editorial System