Private, Public Markets Set to Converge in Race for Retail Cash

PositiveFinancial Markets

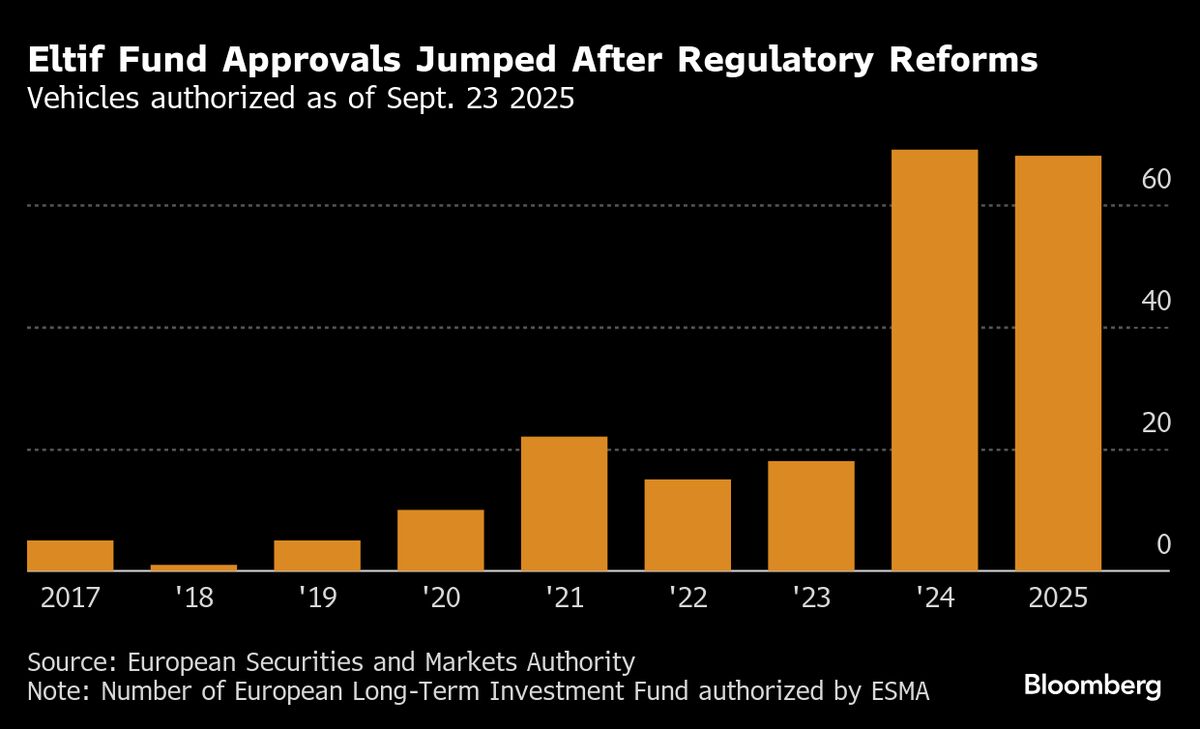

The financial industry is on the brink of a significant transformation as private and public markets are set to converge, a trend highlighted by KKR & Co.’s Philipp Freise. This democratization of private markets is expected to reshape how retail investors access investment opportunities, making it easier for them to participate in previously exclusive markets. This shift not only opens up new avenues for investment but also enhances competition and innovation within the financial sector.

— Curated by the World Pulse Now AI Editorial System