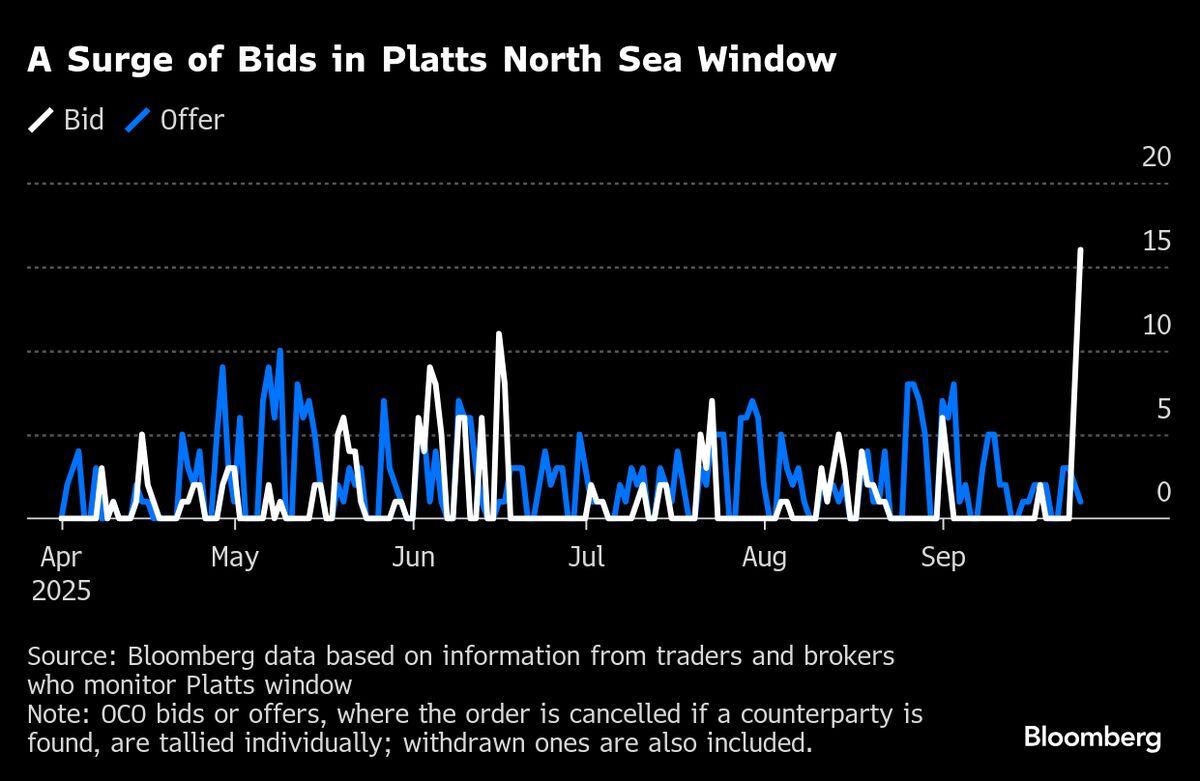

BP, Vitol Lead Crude Bidding Frenzy in North Sea Physical Market

PositiveFinancial Markets

BP and Vitol are making headlines by leading a surge of bids in the North Sea physical market, signaling a stronger oil market despite predictions of a surplus. This is significant as it reflects a shift in market dynamics and could influence pricing trends in the coming months.

— Curated by the World Pulse Now AI Editorial System