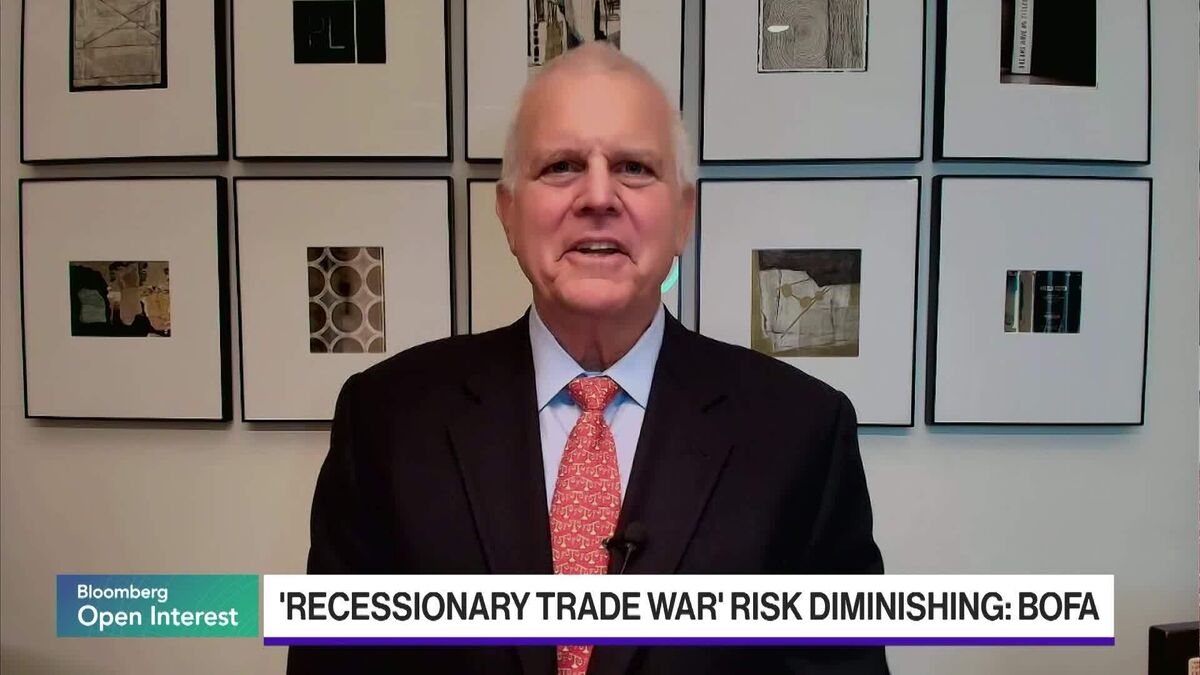

Citi's Chronert Says Fed Rate Cuts to Spur Year-End Rally

PositiveFinancial Markets

Scott Chronert from Citi predicts that the Federal Reserve's rate cuts will lead to increased volatility in the US equity market, followed by a rally by year-end.

Editor’s Note: This is significant as it suggests that investors may see opportunities for growth in the stock market, especially after a period of uncertainty. Understanding these predictions can help investors make informed decisions.

— Curated by the World Pulse Now AI Editorial System