Why Ending the De Minimis Rule Could Cost Consumers

NegativeFinancial Markets

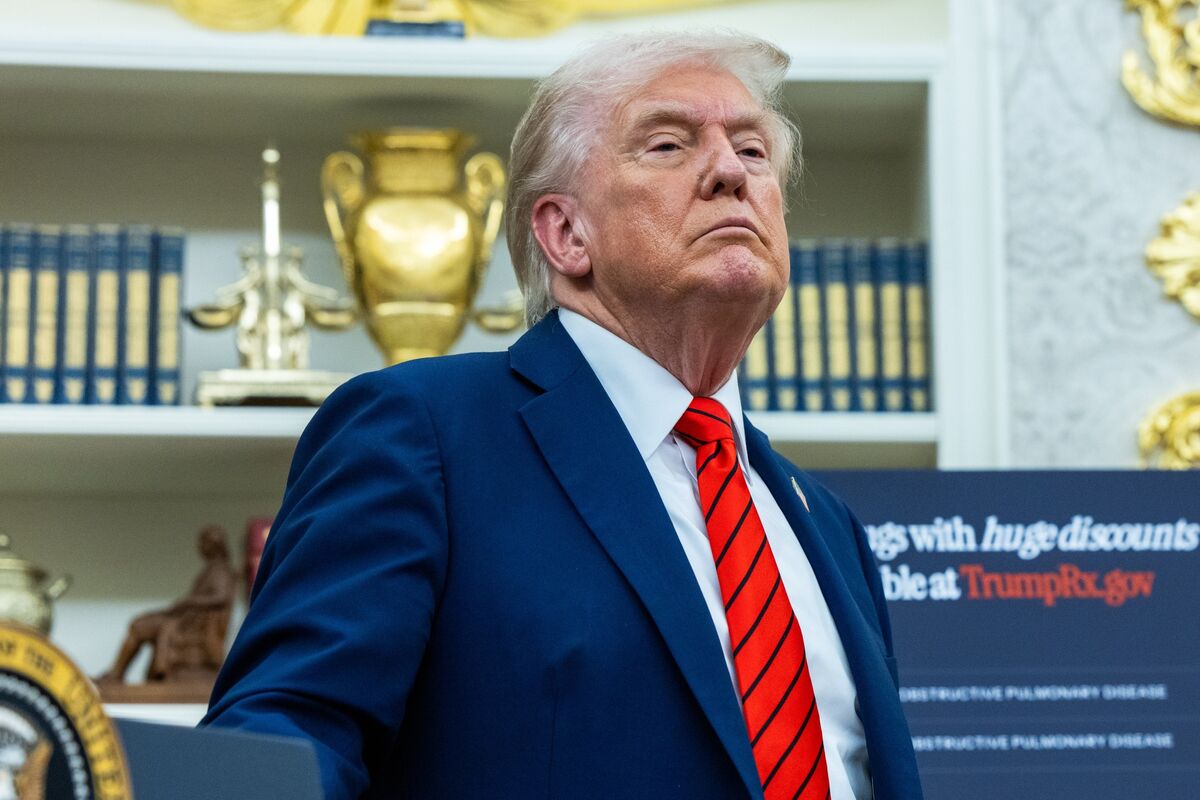

The recent end of the de minimis rule by the Trump Administration is causing significant challenges for small businesses globally. This rule previously allowed shipments under $800 to enter the US without tariffs, simplifying the import process for independent sellers. Now, artists like Harriet de Winton are facing new costs and confusion, as the policy shift intended to limit cheap imports from China is inadvertently impacting small entrepreneurs. This change matters because it highlights the unintended consequences of trade policies on small businesses, which are vital to the economy.

— Curated by the World Pulse Now AI Editorial System