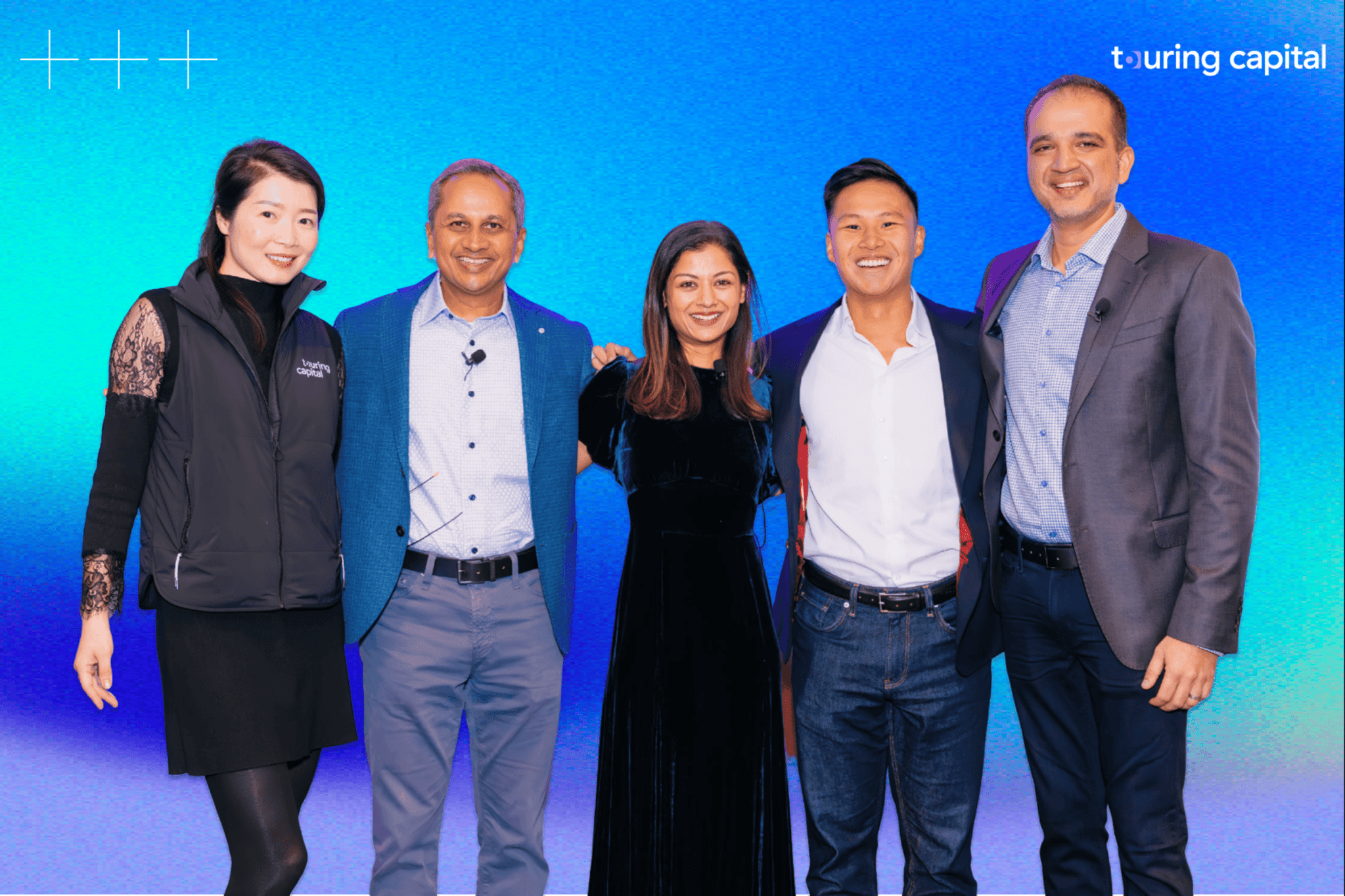

Exclusive: Touring Capital, founded by ex-M12 and SoftBank investors, closes $330 million first fund

PositiveFinancial Markets

Touring Capital, a new venture firm established by former investors from M12 and SoftBank, has successfully closed its inaugural fund at an impressive $330 million. This milestone is significant as it highlights the growing confidence in the venture capital landscape and the potential for innovative startups to receive substantial backing. With this funding, Touring Capital aims to support emerging companies and drive technological advancements, making it a noteworthy player in the investment community.

— Curated by the World Pulse Now AI Editorial System