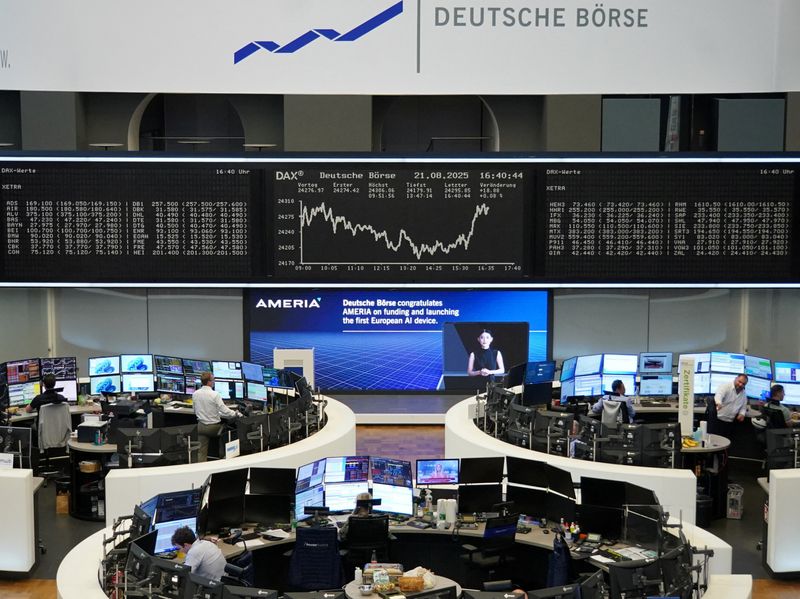

Powell's Jackson Hole Address Sparks Market Anticipation

Federal Reserve Chair Jay Powell is set to deliver a crucial address at the Jackson Hole Economic Symposium, with traders eagerly awaiting insights into future monetary policy. His speech is expected to shape market expectations and economic forecasts.

Trump Administration Pressures Fed Governor Over Fraud Allegations

The Trump administration is escalating its campaign to remove Federal Reserve governor Lisa Cook after she refused to resign amid unproven allegations of mortgage fraud. President Trump has publicly demanded her resignation, claiming she submitted fraudulent information, while Cook asserts she will not be 'bullied' into stepping down.

Dollar Declines as Powell Hints at September Rate Cut

Nvidia Halts H20 AI Chip Production Amid Chinese Scrutiny

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

6,095

264

200

an hour ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

6,095

264

200

an hour ago

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more