See what’s trending right now

Asian tradein Financial Markets

4 hours agoChina's credit demand surges with June yuan loans exceeding forecasts, supported by seasonal factors and bond sales, while Synopsys gains conditional approval to acquire Ansys, signaling regulatory openness.

Show me

Financial Markets

Sovereign Wealth Funds Fear Missing China Tech Boom, Survey Says

PositiveFinancial Markets

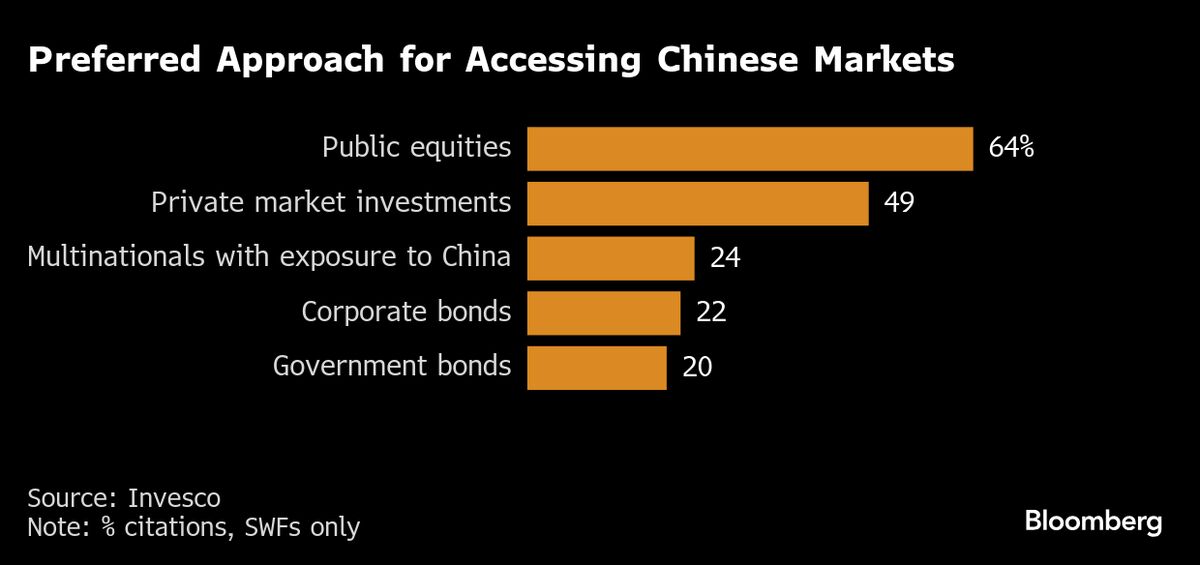

Big-money investors like sovereign wealth funds are getting more optimistic about China's tech industry, according to a new survey. They’re worried about sitting on the sidelines while the next big innovations—think AI, chips, or green tech—take off in China. With $27 trillion in assets under management, these funds aren’t just dabbling; they’re making serious bets.

Editor’s Note: When deep-pocketed investors shift focus like this, it’s a signal. China’s tech sector, despite geopolitical tensions, is still seen as a major growth engine—and nobody wants to be left behind. For markets, this could mean more capital flowing into Chinese tech stocks, startups, or infrastructure. But it also raises questions: Are they underestimating risks, or is this a calculated move for long-term gains? Either way, it’s a story worth watching.

Wealth funds warm to active management - and China - to weather volatility, report shows

NeutralFinancial Markets

Big sovereign wealth funds are shifting strategies to cope with market ups and downs, according to a new report. Instead of just passively tracking indexes, they're leaning into active management—hand-picking investments to chase better returns. And despite geopolitical tensions, many are doubling down on China, seeing it as a key growth opportunity.

Editor’s Note: This isn't just a niche finance story—it’s a sign of how major players are adapting to a shaky global economy. If these deep-pocketed funds are betting on active management and China, it could ripple through markets, affecting everything from stock prices to where capital flows next. For everyday investors, it’s a peek into where the smart money thinks opportunities (and risks) might be hiding.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,179

Trending Topics

116

Sources Monitored

204

Last Updated

4 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

7,179

Trending Topics

116

Sources Monitored

204

Last Updated

4 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more