See what’s trending right now

Techin Financial Markets

4 hours agoTech giants face mixed fortunes as Microsoft gets optimistic stock forecasts ahead of earnings, Tesla struggles with mounting challenges, and a leading AI firm's uncertain growth outlook triggers a massive $30B loss.

Show me

Financial Markets

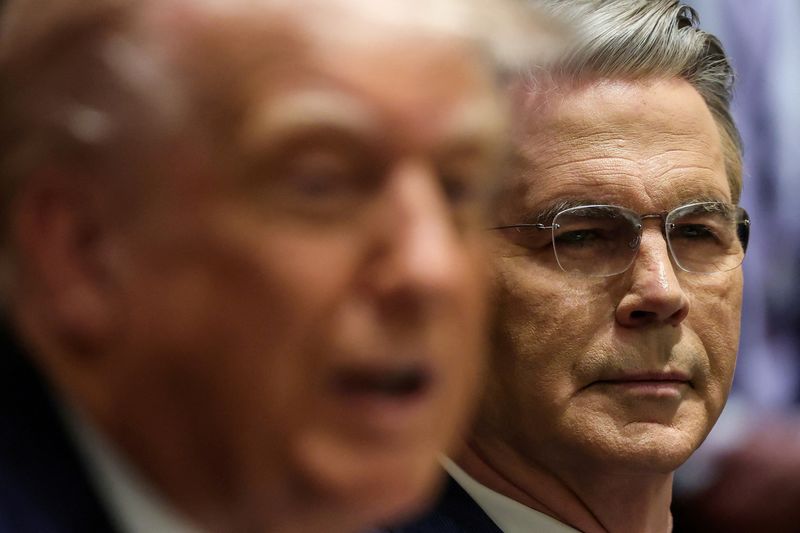

Trump denies reports he’s planning to fire Fed Chair Powell ‘soon’

NegativeFinancial Markets

Former President Donald Trump pushed back on rumors that he’s gearing up to oust Federal Reserve Chair Jerome Powell, calling the reports "fake news." But the initial buzz still sent ripples through financial circles, with experts and business leaders caught off guard by the possibility.

Editor’s Note: Even if Trump’s denial cools things down for now, the mere suggestion of political interference in the Fed—an institution meant to stay independent—rattles markets and raises concerns about stability. Investors hate uncertainty, and this kind of drama doesn’t help.

Trump discussed firing Fed boss but 'highly unlikely' he will

NegativeFinancial Markets

President Trump openly acknowledged that he'd floated the idea of firing Federal Reserve Chair Jerome Powell—a rare and controversial move—but quickly walked it back, calling such action "highly unlikely." The back-and-forth highlights Trump's ongoing frustration with the Fed's interest rate policies, which he blames for slowing economic growth.

Editor’s Note: Presidents usually avoid publicly meddling with the Fed to maintain its independence, so Trump even discussing this shakes confidence in economic stability. Markets hate uncertainty, and this kind of public drama could spook investors. It also raises questions about how much pressure the Fed might feel to align with Trump’s demands—even if Powell stays put.

Trump privately indicates he may soon fire Fed chair Jerome Powell

NegativeFinancial Markets

President Trump is reportedly considering firing Federal Reserve Chair Jerome Powell—a move that would shake Wall Street and raise concerns about political interference in the traditionally independent central bank. Though Trump publicly denies plans to dismiss Powell, private discussions suggest otherwise, leaving markets and policymakers on edge.

Editor’s Note: The Fed is supposed to operate free from political pressure to keep the economy stable. If Trump follows through, it could spook investors, destabilize markets, and set a risky precedent for future presidents meddling with monetary policy. This isn’t just insider drama—it’s about whether the economy stays on steady ground or gets thrown into chaos.

Trump, allies push to remove Fed Chair Powell amid cost overruns, rate cut calls

NegativeFinancial Markets

Former President Donald Trump and his allies are reportedly pressuring to oust Federal Reserve Chair Jerome Powell, citing frustrations over rising costs and demands for interest rate cuts. This push signals growing political tensions over the Fed's handling of inflation and economic policy, with Trump's camp seemingly eager to replace Powell with someone more aligned with their priorities.

Editor’s Note: The Fed is supposed to operate independently to keep the economy stable, but this move suggests an attempt to politicize monetary policy. If Powell were replaced, it could shake investor confidence and raise concerns about whether future rate decisions will be driven by economic need—or political pressure. That’s a big deal for everything from your mortgage rates to your 401(k).

Trump: Bessent an option to replace Fed chair, 'but I like the job he's doing'

NeutralFinancial Markets

Former President Donald Trump floated the idea of replacing current Federal Reserve Chair Jerome Powell with economist Judy Shelton (referred to as "Bessent" in the excerpt, likely a misstatement) but quickly backtracked, saying he’s generally satisfied with Powell’s performance. The comment reflects Trump’s habit of publicly musing about personnel changes—sometimes seriously, sometimes not—while keeping observers guessing.

Editor’s Note: Trump’s offhand remarks about Fed leadership matter because the central bank’s decisions impact everything from interest rates to inflation. Even casual speculation can rattle markets or signal shifts in economic policy priorities. It’s also a reminder of how much influence a president (or former president) can wield just by talking—whether they mean it or not.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

9,537

Trending Topics

125

Sources Monitored

204

Last Updated

4 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Stay informed, save time

Learn moreLive Stats

Articles Processed

9,537

Trending Topics

125

Sources Monitored

204

Last Updated

4 hours ago

Live data processing

How it works1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more